Chemicals Division

Division Strategy

We will realize sustainable growth both by strengthening the trade business to avoid divides in the supply chain and by creating next-generation businesses that align with a low-carbon, environmentally friendly society.

Kenji Maeda

Executive Officer, COO

Chemicals Division

The Chemicals Division aims to continuously generate profit for the year of more than 30 billion yen. To this end, we are implementing three basic policies: strengthening of our trading businesses, business investment and financing in areas of expertise, and environmental investment and financing in response to next-generation market needs. Growing, creating, and strengthening trading businesses are our top priorities. Accordingly, we will be focused on building stable earnings foundations in these businesses to address the shifts and rising geopolitical risks seen in the chemicals industry as we take swift and flexible action to seize new business opportunities. At the same time, we will be advancing measures to modernize our operations through digital transformation strategies, organizational optimization, divestiture from or rehabilitation of underperforming businesses, infrastructure investments, and digitalization.

Strengths of the Division

-

Customer base of over 5,000 companies

-

Wide variety of products and materials

-

Ability to make proposals in response to the

changing business environment

- Wide variety of products, materials, and business proposal capabilities

for upstream, midstream, and downstream areas - Extensive customer network of over 5,000 companies around the world

- Top-level business scale and name recognition among general trading companies

- Operational know-how accumulated through gas chemical business

- Plastic resin business with a global sales and procurement network

- Business expertise in the C5* and petroleum resin business value chain

- Large share and stable supply of Indian-sourced industrial salt in the Asian market

*C5 Fraction produced as a co-product of naphtha cracking that is used as a raw material for synthetic rubber and plastic resin

Global Operations

Business Map

C5 and Petroleum Resin Business: Cymetech Corporation, Metton America Inc. (U.S.)

Industrial Salt Business (India)

Business Overview

■ Environment and Life Science Business

In preparation for the transition to a decarbonized society, the Chemicals Division is pursuing business development in three fields: 1) Biochemicals, 2) Green biotechnology, and 3) Plastics recycling. The division aims to provide sustainable materials to clients seeking decarbonization solutions through the commercialization of a biochemical manufacturing process that leverages microbial fermentation. We are also working to establish a sales platform for agricultural supplies, primarily focusing on the sale of slow-release fertilizer and handling products such as biostimulants that help reduce environmental impact. Through the commercialization of a recycling process that converts high-quality mono-material waste plastic into high value-added materials, we aim to generate new demand for a recycling process that is not reliant on petrochemicals. By advancing these initiatives, the Chemicals Division aims to both ensure the sustainability of its business portfolio and enhance the value of Sojitz Group.

■ Rare Earths Business

Through ongoing investment in Australia-based Lynas Rare Earths Ltd., Sojitz has established an over 10-year track record in the sale of Lynas’s rare earth materials (light rare earths). Lynas aims to begin production of medium and heavy rare earths in 2025, with plans to expand its product range going forward.

■ Industrial Salt Business

Sojitz possesses over 30 years of experience in the production and sale of industrial salt produced through the solar evaporation method in Gujarat, India. Sojitz provides a stable supply of Indian industrial salt to chlor-alkali manufacturers across Japan, Asia, and the Middle East that use the product as a key raw material in the production of chlorine and caustic soda.

■ Methanol Business

Sojitz supports the foundations of the fuel and chemicals industry in Indonesia as the majority shareholder and operator of the sole methanol production company in the country. Additionally, Sojitz is involved in the development of plant-derived biochemicals, and we aim to establish new business that will contribute to a carbon neutral society.

■ C5 and Petroleum Resin Business

For over 15 years, Sojitz has developed a product chain for dicyclopentadiene (DCPD) in the U.S. We fully own and operate Metton America, Inc., a poly DCPD resin manufacturer, and Cymetech Corporation, which produces the raw material DCPD. Sojitz has established an integrated supply framework for DCPD that encompasses both raw material supply and resin manufacturing.

■ Plastic Resin Business (Sojitz Pla-Net Corporation, Pla Matels Corporation)

The Chemicals Division is developing businesses in three growth fields that contribute to the environment as well as to communities. These fields are food packaging, green plastics and recycling, and next generation automotive components. In the food packaging field, we are supplying items that address changing lifestyles in Europe and the United States while also introducing these items into China and other Asian markets. Meanwhile, the insight and inter-personal networks we have developed in environmental and recycling fields are being utilized to accelerate recycling field initiatives related to green polyethylene, biomass, and marine biodegradable resins. We are also offering one-stop service for resins and electronics manufacturing services in relation to automotive components. Through these various initiatives, we will pursue balanced increases in the value of Sojitz Pla-Net Corporation and Pla Matels Corporation.

■ SBR Latex and ABS Resins Business (Nippon A&L Inc.)

Nippon A&L Inc. is recognized as a global supplier with advanced technology in SBR latex used as anode binders for lithium-ion batteries (LiB), for which demand is expanding due to the widespread adoption of electric vehicles. In the field of SBR latex for paper processing, the company boasts one of Japan’s leading supply chains and is highly regarded in both areas. Additionally, in ABS resin used for automobiles and home appliances, Nippon A&L has a stable customer base both domestically and internationally, supported by its high level of technological expertise. We are committed to further enhancing Nippon A&L’s corporate value and expanding its business into the EV and storage battery markets by combining Nippon A&L technology and Sojitz’s management resources and business expertise.

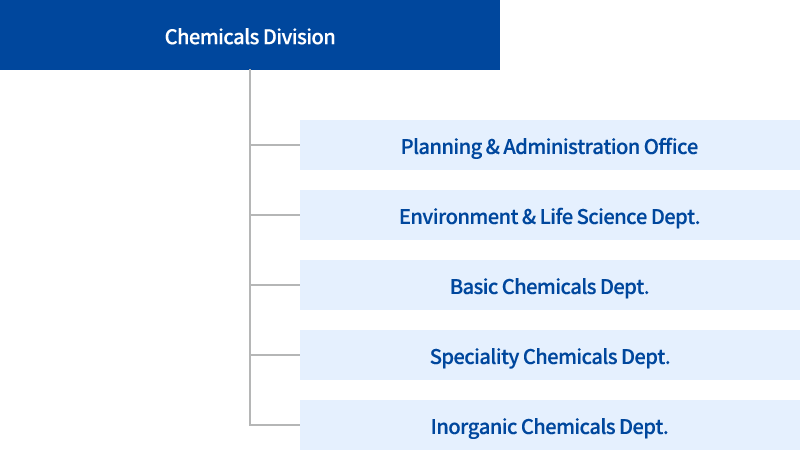

Organization

Latest Information

-

Oct. 30, 2025

Topics

Sojitz Begins Import of Heavy Rare Earths from Australia

-

Jun. 20, 2025

Information

Establishment of New Company by Sojitz Pla-Net and Pla Matels

-

May 15, 2025

News Release

Sojitz Acquires Majority Shares in NIPPON A&L INC.

-

Aug. 4, 2023

News Release

Development of Innovative Biomanufacturing Technologies Using CO₂ and H₂ as Feedstocks for Hydrogen-oxidizing Bacteria

-

Jul. 18, 2023

News Release

Sojitz Invests in Hycamite TCD Technologies Oy in Finland, a Developer of Turquoise Hydrogen Production Technology

Related Contents

-

Featured Business Projects

Sojitz’s Industrial Salt Business in India:

Supplying a Key Building Block of Global IndustryView details

-

New way, New value by Sojitz Person

Business Begins with Excitement

Hiroki Kusada / Deputy Section Manager of Inorganic Chemicals Section 1, Inorganic Chemicals Department, Chemicals Division

View details