Last

JPY

JPY

(%)

Securities Code : 2768

Last

JPY

JPY

(%)

(Real Time)

JPY

%

BN JPY

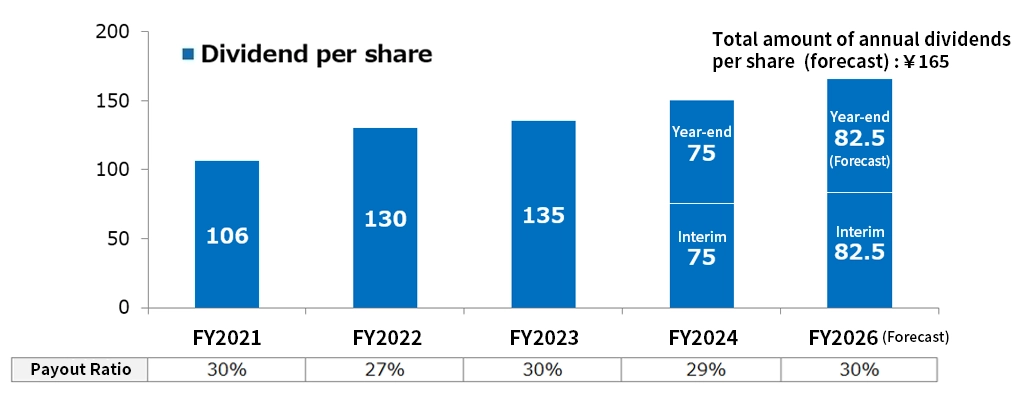

In addition to paying stable dividends to shareholders on an ongoing basis, Sojitz is also committed to enhancing shareholder value and improving its competitiveness by accumulating and effectively utilizing retained earnings as a basic policy and a top management priority.

Under this basic policy, the Medium-Term Management Plan 2026 launched in April 2024 sets a progressive dividend policy based on 4.5% of shareholder equity(※) .

as of May 1, 2025

| Cash Dividends per Share | |||

|---|---|---|---|

| Interim | Year-end | Annual | |

| For the year ending March 31, 2026 | ¥82.5 | ¥82.5(forecast) | ¥165(forecast) |

| For the year ending March 31, 2025 | ¥75 | ¥75 | ¥150 |

| For the year ending March 31, 2024 | ¥65 | ¥70 | ¥135 |

| For the year ended March 31, 2023 | ¥65 | ¥65 | ¥130 |

| For the year ended March 31, 2022※ | ¥9 | ¥61 | - |

| Cash Dividends per Share | |||

|---|---|---|---|

| Interim | Year-end | Annual | |

| For the year ended March 31, 2021 | ¥5 | ¥5 | ¥10 |

| For the year ended March 31, 2020 | ¥8.5 | ¥8.5 | ¥17 |

| For the year ended March 31, 2019 | ¥7.5 | ¥9.5 | ¥17 |

| For the year ended March 31, 2018 | ¥5 | ¥6 | ¥11 |

| For the year ended March 31, 2017 | ¥4 | ¥4 | ¥8 |

| For the year ended March 31, 2016 | ¥4 | ¥4 | ¥8 |

| For the year ended March 31, 2015 | ¥2.5 | ¥3.5 | ¥6 |

| For the year ended March 31, 2014 | ¥2 | ¥2 | ¥4 |

| For the year ended March 31, 2013 | ¥1.5 | ¥1.5 | ¥3 |

| For the year ended March 31, 2012 | ¥1.5 | ¥1.5 | ¥3 |

| For the year ended March 31, 2011 | ¥1.5 | ¥1.5 | ¥3 |

| For the year ended March 31, 2010 | ¥2.5 | ¥0 | ¥2.5 |

| For the year ended March 31, 2009 | ¥4.5 | ¥1 | ¥5.5 |

| For the year ended March 31, 2008 | ¥3.5 | ¥4.5 | ¥8 |

| For the year ended March 31, 2007 | ─ | ¥6 | ¥6 |

| Repurchase Period | Total Number of Shares | Total Purchase Price |

|---|---|---|

| From October 1, 2024 to March 24, 2025 | 6,500,000 shares | ¥ 20,927,075,900 |

| From February 26, 2024 to April 5, 2024 | 4,000,000 shares | ¥ 15,637,882,300 |

| From April 10, 2023 to September 22, 2023 | 9,789,300 shares | ¥ 29,999,845,400 |

| From May 1, 2021 to September 22, 2021 | 44,516,400 shares | ¥ 14,999,965,900 |

| From April 1, 2020 to April 23, 2020 | 20,315,900 shares | ¥ 4,999,982,600 |

We do not have hospitality programs for shareholdes.

Our fundamental policy is to provide equal distribution to shareholders through the continuous and stable dividends made possible by increases in corporate value.

This Website was created for the purpose of providing information relating to Sojitz corporation. It was not created to solicit investors to buy or sell Sojitz Corporation's stock. The final decision and responsibility for investments rests solely with the user of this Website and its content.

This website contains forward-looking statements about future performance, events or management plans of the Company based on the available information, certain assumptions and expectation at the point of disclosure, of which many are beyond the Company’s control. These are subject to a number of risks, uncertainties and factors, including but not limited to, economic and financial conditions, factors that may affect the level of demand and financial performance of the major industries and customers we serve, interest rate and currency fluctuations, availability and cost of funding, fluctuations in commodity and materials prices, political turmoil in certain countries and regions, litigations claims, change in laws, regulations and tax rules, and other factors. Actual results, performances and achievements may differ materially from those described explicitly or implicitly in the relevant forward-looking statements. The Company has no responsibility for any possible damages arising from the use of information on this website.

Although the information on this website is prepared with the greatest care, the Company does not guarantee the accuracy, continuity or quality of any information provided on this website or that it is up-to-date, nor does it accept responsibility for any damage or loss arising from the falsification of data by third parties, data downloads, etc., irrespective of the reasons therefore.

Please also be aware that information on this Website may be changed, modified, added or removed at any time without prior notice.