Last

JPY

JPY

(%)

Securities Code : 2768

Last

JPY

JPY

(%)

(Real Time)

JPY

%

BN JPY

The following are basic rules for the proper disclosure of company information to shareholders, investors, and other stakeholders.

■ Observe laws and regulations related to information disclosure

Observe regulations of the Tokyo Stock Exchange, the Financial Instruments and Exchange Act, the Companies Act, and any related laws and regulations.

■ Transparency

Disclose information based on actual fact, regardless of the content.

■ Timeliness

Disclose any information which should be disclosed in a timely fashion.

■ Fairness

Disclose information fairly to all stakeholders.

■ Consistency

Keep disclosed information consistent.

■ Confidentiality

Ensure that no information is leaked to a third party (including other Sojitz officers and employees) prior to official disclosure by the Company

This Policy applies to the following types of disclosure, governing information which is to be made public or assumed to be made public.

■ Disclosure requested by the Tokyo Stock Exchange

Information which the Tokyo Stock Exchange requests us to disclose in a timely manner, including 1) material facts related to corporate decisions and occurrences, etc. or 2) corporate governance reports, notices filed to the TSE regarding appointment of executives, etc.

■ Disclosure based on the Financial Instruments and Exchange Act

Security reports, Quarterly Reports, Internal Control Reports, Extraordinary Reports, etc.

■ Disclosure based on the Companies Act

Business reports, Financial Statements /Consolidated Financial Statements and supplementary schedules, etc.

■ Disclosure of other information

Materials regarding Consolidated Financial Results, Integrated Reports, Shareholders’ Magazine, News Releases, materials posted to the Sojitz website, other materials the Company chooses to disclose.

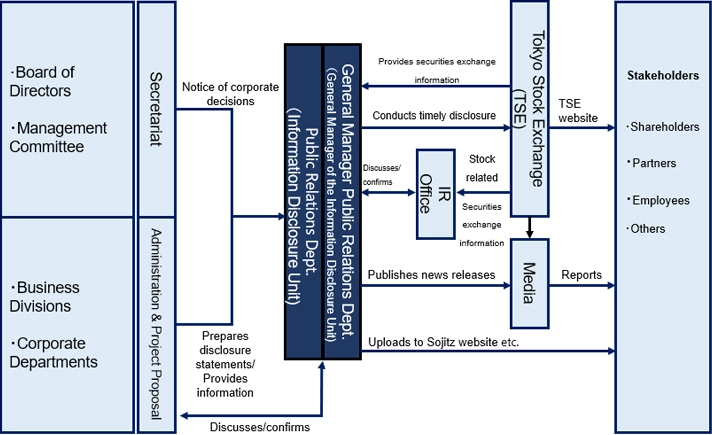

The following framework has been established for the disclosure of information.

(1) Framework for timely disclosure of information

(2) Decision for timely disclosure

The Information Disclosure Unit shall consider whether to disclose information collected internally after consulting Timely Disclosure Rules set by the Tokyo Stock Exchange. Following this, the General Manager of the Information Disclosure Unit shall have the final decision about whether to disclose information.

(3) Procedure for timely disclosure of information

Material facts regarding corporate decisions and financial results shall be disclosed without delay after the General Manager of the Information Disclosure Unit assesses the need for timely disclosure, and as necessary, the Company’s highest decision-making body (the Board of Directors, etc.) gives their final judgment. Material facts regarding events and occurrences shall be disclosed without delay after the General Manager of the Information Disclosure Unit assesses the need for timely disclosure, and as necessary, the decision is discussed by the top management. The Information Disclosure Unit shall be responsible for the actual disclosure of information.

(4) How to Conduct Timely Disclosure of Information

Items to be disclosed according to Timely Disclosure Rules shall be posted to the Company website as soon as possible, following their disclosure on TDnet (the Tokyo Stock Exchange’s ‘Timely Disclosure Network’). For items which do not require disclosure according to Timely Disclosure Rules and for which disclosure is thus voluntary, Sojitz should take care to disclose this information in a manner similar to that used for timely disclosure of information for stakeholders.

(1) Framework

Each kind of information to which “timely disclosure” does not apply is assigned a department which oversees its disclosure. The department will disclose said information upon receiving the approval of an authorized person from the department, depending on the content of the information disclosed.

(2) Establishment and oversight of disclosure protocol

Responsible departments should not only draft the disclosure text and confirm any changes to laws and regulations prior to the disclosure; they should also put together disclosure instructions (“Instructions”) which clearly explain the process for drafting documents and obtaining internal approval for each piece of information to be disclosed. They should also revise these Instructions regularly.

The Disclosure Working Group will confirm the scope of company information disclosure each year, check the appropriateness and accuracy of disclosure procedures contained in the Instructions, and report their findings to the Management Committee or the President.

The Company will make every effort to ensure that all employees handle company information appropriately, establishing not only “Regulations for Disclosure of Information.” and “Regulations for External PR” concerning information disclosure related work and procedures carried out by each organization as stated in this policy, but also “Regulations to Prevent Insider Trading.” and the “Sojitz Group Code of Conduct and Ethics”.

The Company shall, as a general rule, refrain from responding to any questions regarding market rumors or speculative media reports published on company information. If ignoring said information is deemed to potentially have a large impact on the Company, however, the Company shall respond as appropriate, such as by disclosing certain information voluntarily or disclosing information by press release.

The Company shall enter a “quiet period” three weeks prior to announcing the financial results and refrain from responding to comments or questions regarding the closing in order to prevent closing-related information from leaking and ensure fairness in information disclosure. However, material information requiring timely disclosure under the Timely Disclosure Rules, such as revisions to earnings forecast and dividends projections, will not be subject to such restriction during the quiet period.

“Selective disclosure” refers to disclosure of undisclosed material facts to specific persons or groups prior to formal public announcement. Excluding cases where privacy must be preserved due to certain non-disclosure agreements, Sojitz prohibits all selective disclosure.

Sojitz’s basic approach to communication with its shareholders

Sojitz’s investor relations activities

This Website was created for the purpose of providing information relating to Sojitz corporation. It was not created to solicit investors to buy or sell Sojitz Corporation's stock. The final decision and responsibility for investments rests solely with the user of this Website and its content.

This website contains forward-looking statements about future performance, events or management plans of the Company based on the available information, certain assumptions and expectation at the point of disclosure, of which many are beyond the Company’s control. These are subject to a number of risks, uncertainties and factors, including but not limited to, economic and financial conditions, factors that may affect the level of demand and financial performance of the major industries and customers we serve, interest rate and currency fluctuations, availability and cost of funding, fluctuations in commodity and materials prices, political turmoil in certain countries and regions, litigations claims, change in laws, regulations and tax rules, and other factors. Actual results, performances and achievements may differ materially from those described explicitly or implicitly in the relevant forward-looking statements. The Company has no responsibility for any possible damages arising from the use of information on this website.

Although the information on this website is prepared with the greatest care, the Company does not guarantee the accuracy, continuity or quality of any information provided on this website or that it is up-to-date, nor does it accept responsibility for any damage or loss arising from the falsification of data by third parties, data downloads, etc., irrespective of the reasons therefore.

Please also be aware that information on this Website may be changed, modified, added or removed at any time without prior notice.