Last

JPY

JPY

(%)

Securities Code : 2768

Last

JPY

JPY

(%)

(Real Time)

JPY

%

BN JPY

In the year ended March 31, 2025, the first year of Medium-term Management Plan 2026—Set for Next Stage, Sojitz was able to deliver results that surpassed its initial forecasts. This impressive performance was achieved despite the sluggish results in certain business fields due to external factors such as larger-than-expected declines in resource prices. We were able to offset the impacts of such factors, however, with earnings contributions from new investments and growth in existing businesses. Our earnings foundation is becoming increasingly more stable due to a reduction in the portion of our earnings derived from resource businesses that are highly susceptible to market changes and growth in earnings gained from nonresource businesses. This increased stability of our earnings foundation can be seen in our ability to post profit for the year (attributable to owners of the Company) exceeding ¥100.0 billion for three consecutive years.

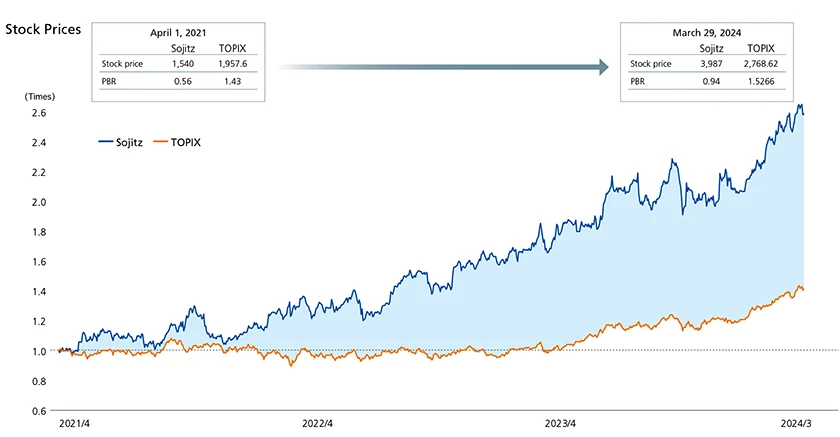

At the same time, however, our price-to-book ratio (PBR) stood at a low 0.77 times on June 30, 2025. This indicates that the market has not been sufficiently convinced of the Company’s ability to accomplish the targets defined for its next stage, namely, profit for the year of ¥200.0 billion, return on equity (ROE) of 15%, and market capitalization of ¥2.0 trillion. Since the announcement of Medium-term Management Plan 2026, we have continued to meet with numerous investors to discuss how we can address this gap between Sojitz’s capabilities and the market’s appraisal of the Company’s potential. The input we have received from investors can largely be divided into two categories. The first category includes requests for further clarification regarding what exactly constitutes the Sojitz Growth Story and how we will craft this story to advance toward our next stage. In response to this feedback, we have proceeded to include examples of initiatives in business areas and segments embodying the Sojitz Growth Story alongside our quarterly financial results announcements. Through these ongoing explanations of our actual initiatives, policies, and numerical results, we are fostering understanding of Sojitz’s distinctive strengths and competitive edge. Examples of such initiatives have also been included within the pages of this integrated report. The second category includes queries about why our stock price remains low, despite offering praise for our management strategies, past performance, and current progress, all indicating that we are heading in the right direction. Possible reasons for our low stock prices include a lack of confidence from the capital market with regard to Sojitz’s future potential for ongoing growth and a disparity between our actual levels of profit and ROE and the returns expected by investors.

As for cost of capital, we maintain our estimate from last year of between 9% and 10%. At the same time, however, we recognize that the market expects returns of around 15%. Sojitz has defined an ROE target of 15% for its next stage. Accomplishing this target will require improvements from our current ROE level of between 11.7% and 12.0%, but we do not see this growth target as unrealistic. Our efforts to reach this level will entail continuing to boost the earnings power of existing businesses and the rigorous advancement of growth strategies for identifying new investment fields to organically link multiple businesses and thereby produce revenue-generating clusters of businesses (Katamari). Progress toward this target will be quantitatively gauged through comparison to the targets for cash return on invested capital (CROIC) set for each business division in order to drive improvements. We will be accelerating these efforts going forward.

With regard to shareholder returns, there has been no change to our basic policy of stable, ongoing returns. However, Sojitz is presently in a growth phase, and we therefore must place emphasis on growth investments. Nevertheless, we will continue to provide highly predictable shareholder returns based on a policy of allocating around 30% of core operating cash flow to returns. We have also put forth the policy of issuing progressive dividend payments targeting 4.5% of shareholders’ equity. I suspect that shareholders will find this level satisfactory, but I also recognize that it will be crucial for us to continue issuing shareholder returns while increasing returns through new investments.

Sojitz’s approach toward business portfolio management differs from that of manufacturers and other companies and does not entail a focus on any specific segment. As a general trading company, we are always transforming our business portfolio. People are the one constant in the equation. It is our people who continue to create new businesses, who exercise resilience to weather harsh conditions, and who transform what needs to be changed while protecting what should be preserved. This is a core element of Sojitz’s DNA. Today, the world is constantly changing, and it seems like we have a new scenario to deal with every week due to factors such as rising geopolitical risks. It is important that we not preoccupy ourselves with how these changes may be beneficial or detrimental to the Company. Rather, we should heighten our perceptiveness toward changing conditions—and this mindset needs to be adopted by both management and frontline staff. I am thus always encouraging people to be more perceptive and to speak up and make suggestions when they notice an issue in order to facilitate swift action.

Under Medium-term Management Plan 2026, we intend to invest around ¥600 billion. In the year ended March 31, 2025, the first year of the plan, we invested around ¥100 billion, and we have already approved another ¥150 billion in investments. I think these figures represent smooth progress toward the aforementioned investment target. However, it is not our intention to simply move forward with investments as planned to meet this target; we also aim to seek out promising opportunities to conduct high-quality investments. Medium-term Management Plan 2026 also earmarks ¥300 billion for new investments for transforming our business portfolio. This provision is meant to allow us to swiftly act on projects deemed to be of strategic importance. Business divisions will not be confined by their investment budgets. Rather, they will be encouraged to share information on projects that could be vital to the entire Company at an early stage to expedite the decisionmaking process. Moreover, our ongoing investment efforts are helping us build relationships with partners and gain access to new opportunities, thereby creating a virtuous cycle in which successful projects lead to new partnerships.

Sojitz is currently saddled with a perceived high cost of capital and faced with a lack of trust regarding its ability to accomplish its targets. This situation underscores the importance of increasing the portion of our portfolio attributable to businesses generating steady growth and reliable earnings. Accordingly, we are looking to foster anticipation for our future growth through a focus on investments in fields where we can more effectively exercise our functions and transform change into opportunities. In existing businesses, we will continue to refine our operations to enhance profitability. At the same time, we will consider the option of transferring a business if we determine that a partner can develop the business more effectively.

As we work toward our goal of doubled corporate value, there are some businesses in which we are poised to target quintupled value, while there are others in which we are forced to prioritize eliminating losses. To get senior management and business division leadership on the same page in this regard, we have engaged in a great deal of discussion to clarify our respective roles. As a result, I feel that the goals of our business divisions have been successfully aligned with the directives defined on a Companywide level.

As we work to promote the Sojitz Growth Story, I believe that I have three roles to play as CFO. The first is to cultivate understanding of the Sojitz Growth Story within the capital market and communicate how exactly we will go about writing this story. The second is to accelerate our efforts in realizing the Sojitz Growth Story. The third is to help build a portfolio that will enable us to pen this story as a collective of integrated businesses, as opposed to a group of standalone businesses. Management is firmly committed to operating Sojitz as both a quality company and a quality investment target. As we seek to craft the Sojitz Growth Story, we will do so by striving to simultaneously live up to investors’ expectations and improve employee satisfaction. I hope we can look forward to your ongoing support and understanding.

*Organization affiliations and titles are current as of July 2025.

This Website was created for the purpose of providing information relating to Sojitz corporation. It was not created to solicit investors to buy or sell Sojitz Corporation's stock. The final decision and responsibility for investments rests solely with the user of this Website and its content.

This website contains forward-looking statements about future performance, events or management plans of the Company based on the available information, certain assumptions and expectation at the point of disclosure, of which many are beyond the Company’s control. These are subject to a number of risks, uncertainties and factors, including but not limited to, economic and financial conditions, factors that may affect the level of demand and financial performance of the major industries and customers we serve, interest rate and currency fluctuations, availability and cost of funding, fluctuations in commodity and materials prices, political turmoil in certain countries and regions, litigations claims, change in laws, regulations and tax rules, and other factors. Actual results, performances and achievements may differ materially from those described explicitly or implicitly in the relevant forward-looking statements. The Company has no responsibility for any possible damages arising from the use of information on this website.

Although the information on this website is prepared with the greatest care, the Company does not guarantee the accuracy, continuity or quality of any information provided on this website or that it is up-to-date, nor does it accept responsibility for any damage or loss arising from the falsification of data by third parties, data downloads, etc., irrespective of the reasons therefore.

Please also be aware that information on this Website may be changed, modified, added or removed at any time without prior notice.