Last

JPY

JPY

(%)

Securities Code : 2768

Last

JPY

JPY

(%)

(Real Time)

JPY

%

BN JPY

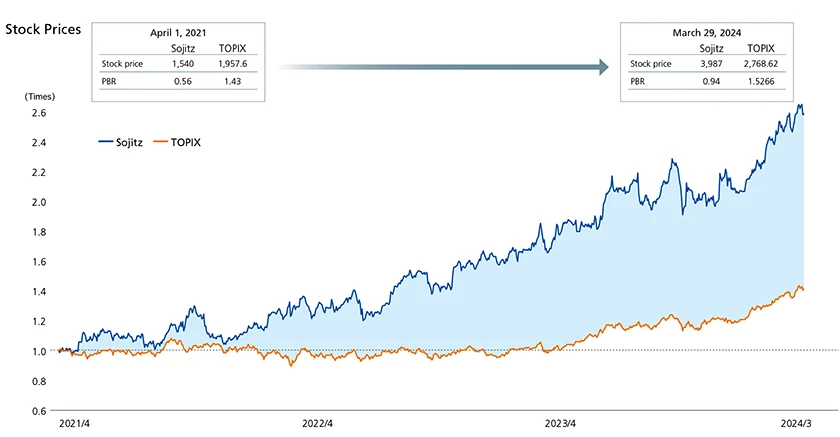

In Medium-Term Management Plan 2023, which was launched in April 2021, Sojitz presented a keen focus on improving corporate value. This focus can be seen in its definition of the price-to-book ratio (PBR) as a key performance indicator (KPI) and its setting of the target of 1.0 times or above for this indicator of the stock market’s assessment of its corporate value. This was quite a lofty goal given the PBR of 0.6 times Sojitz had at the start of the plan. We were able to accomplish this target as well as all of the other quantitative targets of the plan, due in part to the favorable operating environment created by trends like rising resource prices and yen depreciation. It may be impressive that we accomplished these targets, but I have even greater praise for Sojitz’s success in building a stable management foundation that allowed it to achieve profit for the year (attributable to owners of the Company) of more than ¥100.0 billion for two consecutive years and total equity of nearly ¥1.0 trillion. This foundation is an indication of how Sojitz is now poised to pursue future growth. In this manner, Sojitz reached a new stage of growth through the progress made under Medium-Term Management Plan 2023. As such, the policies and measures of Medium-Term Management Plan 2026 were formulated based on the successes of Medium-Term Management Plan 2023 with the aim of achieving further levels of growth. The target of a PBR of 1.0 times or above, in particular, was not an end goal, but rather a milestone on our journey toward future improvements in corporate value and shareholder value.

With its foundation capable of reliably generating profit for the year of more than ¥100.0 billion, Sojitz has defined its goal of transitioning to its next stage, which is defined as being constituted by profit for the year of ¥200.0 billion, return on equity (ROE) of 15%, and market capitalization of ¥2.0 trillion. In the year ended March 31, 2017, when now-Chairman Masayoshi Fujimoto assumed the position of president, Sojitz posted profit for the year of ¥40.8 billion. At the time, the announcement of ¥100.0 billion as a new target was met with surprise and, to a degree, confusion within the Company. Nevertheless, setting a clear goal of ¥100.0 billion made it possible to start thinking about exactly what we needed to do to accomplish this goal. This sparked considerable internal debate on topics that had previously not been explored, and it was this process that ultimately enabled us to achieve this lofty goal. Our goal for the next stage is to double corporate value. By once again setting a clear and concise goal, we look to promote sharing and understanding of our aims on a Companywide basis. The path toward accomplishing this goal will, of course, be discussed internally. At the same time, however, we hope to talk about this subject with our shareholders and other investors. Over the past couple of years, I feel that there has been a clear improvement in the strength of Sojitz’s business foundation as well as real change in employees’ attitudes. I have noticed an increase in employees’ appetite for tackling new challenges and creating new businesses, and this ambition has translated to steady growth in performance. In this manner, I feel that we have also made progress in preparing for future growth from the perspective of our human resources. However, Sojitz will be unable to reach its next stage if we maintain our current approach over the years to come. This is why we will be looking to change our approach in order to accelerate our progress and advance us toward further growth.

Specifically, this change in approach will entail a qualitative transformation to our business portfolio. For Sojitz, portfolio management is not as simple as merely allocating assets to segments with high investment efficiency in order to maximize returns. Rather, we place greater emphasis on non-numerical qualitative improvements to our assets, businesses, and people. To this end, we will faithfully advance growth strategies aimed at creating revenue- generating clusters of businesses, which we refer to as “Katamari” at Sojitz. This will be done by identifying new investment fields that can contribute to improved earnings power in existing businesses and organically linking our multiple businesses. At the same time, we will maintain our focus on enhancing the human resources who support these businesses. Our approach to portfolio management under Medium-Term Management Plan 2026 and thereafter will involve growing the scale of our businesses with an emphasis on quality through this process. I recognize that it is difficult to explain qualitative changes to our business portfolio. Nevertheless, I hope you will understand that, even if the numbers on the balance sheet are the same, qualitative differences in a company’s portfolio can have a great impact on its future growth prospects. We are therefore committed to presenting successful results as soon as possible as proof of these qualitative changes as we craft the Sojitz growth story.

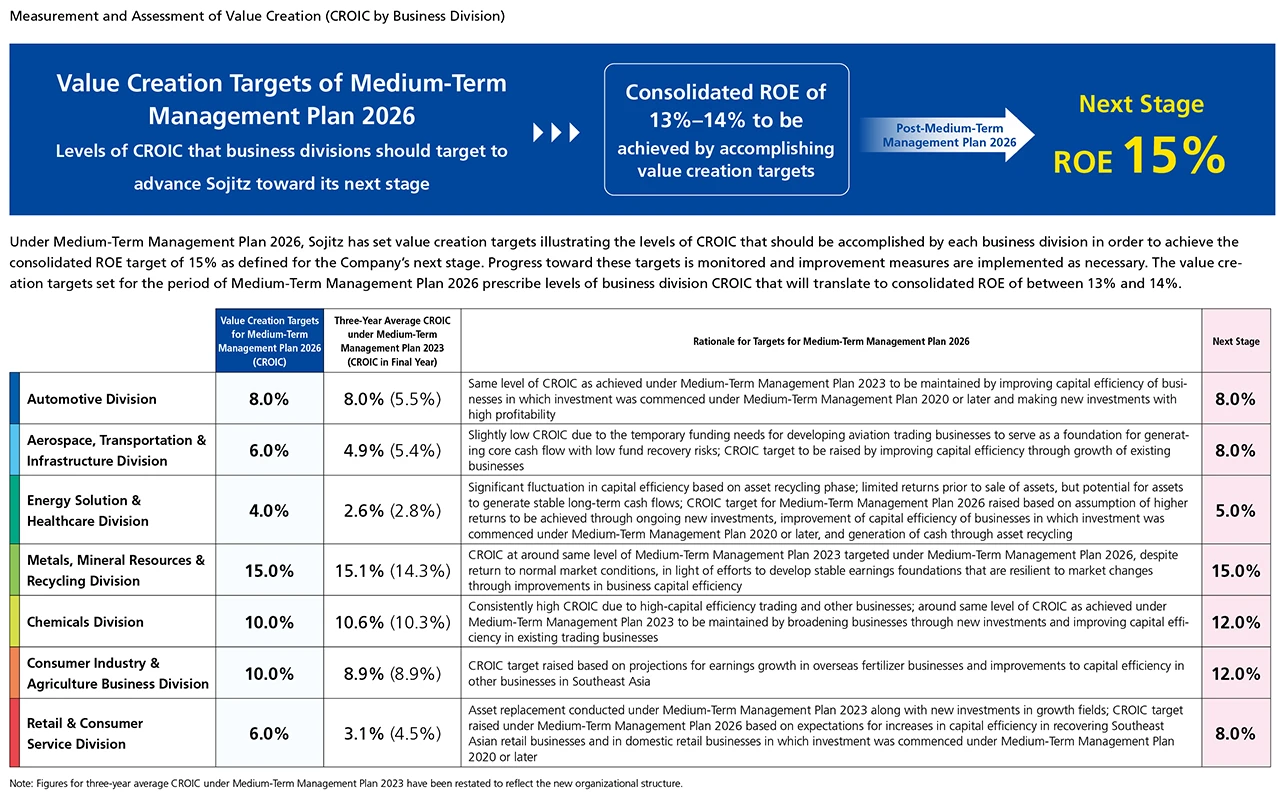

For Medium-Term Management Plan 2023, we introduced the indicator of cash return on invested capital (CROIC). When this past plan was initially formulated, we estimated Sojitz’s cost of capital to be around 7% to 8% and defined 10% or more as the target for return on equity (ROE) to be achieved on a Companywide basis. We then put forth value creation guideline figures representing the targets for CROIC that would need to be accomplished if Sojitz were to achieve the aforementioned ROE target. By tracking the capital efficiency of individual business divisions in this manner, we sought to gain a more concrete understanding of the types of measures needed by each division, and this approach has been contributing to improvements in Companywide capital efficiency. Based on this approach, divisions engaged in infrastructure and retail operations, which have conducted aggressive business investments, have been experiencing relatively low levels of CROIC. This phenomenon is a result of divisions lacking the capacity to generate earnings and cash relative to the increase in assets seen when entering into a new business.

Under Medium-Term Management Plan 2026, each division set targets geared toward accomplishing ROE of 13% to 14%. These targets are aimed not at accomplishing the ROE target of 12% set for the current plan, but rather at moving us toward the ROE target of 15% defined for Sojitz’s next stage. This focus has effectively increased the level of performance expected of each business division. Given that changes in the operating environment have likely increased our cost of capital to around 9% or 10%, it will be important to continue to pursue earnings based on cash returns.

Whether we are investing in businesses or in talent, we first need to generate the cash to fund these investments. Setting targets for the KPI of CROIC for individual business divisions helped increase employee awareness with regard to the need to generate cash. If our only goal is to improve asset efficiency, we can do so relatively easily just by increasing share of profit of investments accounted for using the equity method. However, Sojitz’s goal is to grow earnings based on cash returns, and there is no shortcut toward accomplishing this goal. Accordingly, it will be crucial for us to maintain our focus on hands-on management so that we can achieve our value creation targets by crafting the Sojitz growth story.

During the period of Medium-Term Management Plan 2026, we intend to allocate around 70% of core operating cash flow to investments in growth areas and in human capital while the remaining 30% will be devoted to shareholder returns. The decision to put forth a clear policy of investing in human capital was based on our desire to communicate our intent to invest in both businesses and people in order to fuel Sojitz’s growth toward its next stage. We have earmarked ¥600.0 billion for growth investments during the period of the plan. This figure, however, is not so much a target, but rather the amount of investment that we believe will be feasible to conduct as we continue to practice disciplined cash flow management. Moreover, we have defined two categories of investment under the plan—S-investments and X-investments—and we will be looking to conduct around ¥300.0 billion worth of investments in both of these categories. S-investments are those aimed at strengthening and sustaining our portfolio and will thus represent the continuation of investments in previous target areas. For these investments, we will formulate forecasts for earnings contributions and track our progress in the same manner as has been done under prior medium-term management plans. X-investments, meanwhile, refer to substantive and impactful investments that represent a change in approach to move us toward our next stage. We have also defined an amount of ¥100.0 billion for investments in digital transformation and green transformation to be conducted in the aforementioned two categories.

Our decision to conduct X-investments was based on how our balance sheet has been made more resilient through continuous asset replacement and measures to improve profitability and how our ongoing new investments have expanded our business scope and enabled us to gain market insight and prime partners. It was therefore judged that Sojitz is now capable of carrying out investments of an even larger scale. Accordingly, we will be allocating Companywide resources in a concentrated manner. For important projects that require swift analysis and decision-making, we will take full advantage of Sojitz’s functions* to heighten our rate of success.

At the same time, we will need to control the goodwill that will accumulate as we engage in M&A activities. Sojitz is dedicated to appropriately managing this goodwill based on risks and returns. This will entail assessing risks and returns through monitoring looking at the assumptions on which estimates for the future cash flows from acquisition targets are based. Estimating future cash flows requires consideration of factors such as the growth potential of the market associated with the acquisition target and assessments of its technologies and functions, licenses it might possess, and any rights bestowed by partners. Analyzing and monitoring such factors makes it possible to accurately appraise goodwill and, when necessary, to examine the possibility of replacing an asset.

Based on input gained during interactions with investors, Sojitz has introduced shareholder return policies that are more transparent and predictable than its prior policies. The first of these policies is to allocate 30% of core operating cash flow, on a three-year aggregate basis over the period of the medium-term management plan, to shareholder returns, as I touched on previously. The second is to adopt the indicator of the shareholders’ equity-based dividend on equity ratio (DOE) and to issue annual dividend payments equivalent to 4.5% of shareholders’ equity. In accordance with these two policies, we will stop issuing dividends based on profit for the year, which can fluctuate due to extraordinary factors seen on a single- fiscal year basis or other causes, and instead base dividend payments on shareholders’ equity excluding foreign exchange rates, stock prices, and other variable factors. The resulting framework will allow for progressive dividend increases guided by the shareholders’ equity-based DOE as long as profit for the year exceeds the amount of dividends paid in a given fiscal year. The new policies are thus expected to provide increased predictability and stability in dividend payments. By adhering to our basic shareholder return policies, we look to exercise flexibility in dividend payments as well as in share buybacks.

If we are to double corporate value, we will need to successfully craft the Sojitz growth story. This growth story is not something that can be put into simple terms. However, I think one aspect of this story will be evolving our businesses in response to social needs to create a business model that provides functions geared toward the needs of specific markets and customers, as described in the “ever-evolving business models” section of Medium- Term Management Plan 2026. In our infrastructure-related businesses, for example, we are developing operations aimed at improving the energy efficiency of hospitals and schools. In these operations, we are endeavoring to heighten our value proposition by combining Sojitz’s unique functions through the introduction of renewable energy as well as through other means. In addition to such qualitative improvements to our business, we have also been seeing a rise in cases of operations being expanded into other areas to grow our business. New projects often emerge when the partners we worked with together on successful projects reach out to us. The new projects borne out of these and other cases can create a ripple effect to drive expansion of our business. This occurs because we do not merely limit our involvement to investment; we also engage in hands-on management of businesses. This type of expansion is one aspect of the Sojitz growth story, and I am confident that we can succeed in doubling corporate value if we are able to increase the number of such cases of expansion and their associated scale.

Sojitz recently celebrated the 20th anniversary of its founding, and Sojitz currently possesses a solid foundation capable of consistently generating profit for the year of ¥100.0 billion. The Company’s recent surge in performance, however, is not something that can be credited entirely to those of us at Sojitz today. Rather, the foundation we have today is built on the support of our stakeholders along with the immeasurable efforts and ingenuity of the Sojitz employees who kept the Company going over the years, even when our weak management foundations prevented us from starting promising projects or forced us to give up on projects that were underway before they had a chance to bear fruit. However, we cannot simply continue our current activities without evolving. Our future will be shaped by the people currently at the Company, who will hopefully transform Sojitz for the better. My role as CFO is to lead us in improving the quality of our portfolio to swiftly realize doubled corporate value. I also believe that I have the responsibility of increasing communication with investors and other stakeholders with regard to our path toward doubled corporate value and our successes so as to gain their understanding and support. I am committed to continuing to aid in ongoing improvements to Sojitz’s corporate value.

*Organization affiliations and titles are current as of July 2024.

This Website was created for the purpose of providing information relating to Sojitz corporation. It was not created to solicit investors to buy or sell Sojitz Corporation's stock. The final decision and responsibility for investments rests solely with the user of this Website and its content.

This website contains forward-looking statements about future performance, events or management plans of the Company based on the available information, certain assumptions and expectation at the point of disclosure, of which many are beyond the Company’s control. These are subject to a number of risks, uncertainties and factors, including but not limited to, economic and financial conditions, factors that may affect the level of demand and financial performance of the major industries and customers we serve, interest rate and currency fluctuations, availability and cost of funding, fluctuations in commodity and materials prices, political turmoil in certain countries and regions, litigations claims, change in laws, regulations and tax rules, and other factors. Actual results, performances and achievements may differ materially from those described explicitly or implicitly in the relevant forward-looking statements. The Company has no responsibility for any possible damages arising from the use of information on this website.

Although the information on this website is prepared with the greatest care, the Company does not guarantee the accuracy, continuity or quality of any information provided on this website or that it is up-to-date, nor does it accept responsibility for any damage or loss arising from the falsification of data by third parties, data downloads, etc., irrespective of the reasons therefore.

Please also be aware that information on this Website may be changed, modified, added or removed at any time without prior notice.