Last

JPY

JPY

(%)

Securities Code : 2768

Last

JPY

JPY

(%)

(Real Time)

JPY

%

BN JPY

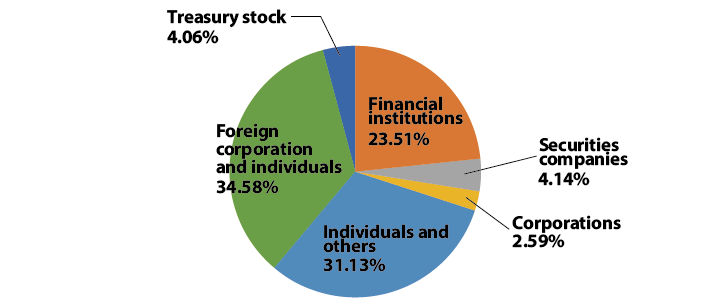

As of March 31, 2021

| Securities code | 2768 |

|---|---|

| Stock listing | Tokyo Stock Exchange |

| Fiscal year | From April 1 to March 31 of the next year |

| General shareholders’ meeting | June |

| Year-end dividend record date | March 31 |

| Interim dividend record date | September 30 |

| Shareholder registry administrator | Mitsubishi UFJ Trust and Banking Corporation |

| Number of shares per unit | 100 shares |

| Total number of shares authorized to be issued | 2,500,000,000 |

| Number of shares issued and outstanding | 1,251,499,501 |

| Number of shareholders | 214,354 |

As of March 31, 2021

Note:The sum of each ratio is not 100% because each ratio has been rounded off.

| Name of Shareholders | Number of Shares Held (thousands) | Shareholding Ratio(%) |

|---|---|---|

| Custody Bank of Japan, Ltd. | 147,026 | 12.25% |

| Ichigo Trust Pte. Ltd. | 123,634 | 10.30% |

| The Master Trust Bank of Japan, Ltd. | 94,062 | 7.83% |

| JAPAN SECURITIES FINANCE CO., LTD. | 16,161 | 1.35% |

| STATE STREET BANK WEST CLIENT - TREATY 505234 | 14,894 | 1.24% |

| JP MORGAN CHASE BANK 385781 | 14,720 | 1.23% |

| THE BANK OF NEW YORK MELLON 140044 | 14,080 | 1.17% |

| GOVERNMENT OF NORWAY | 13,496 | 1.12% |

| NORTHERN TRUST CO.(AVFC) RE UK PENSION FUNDS EXEMPT LENDING ACCOUNT | 12,191 | 1.02% |

| JPMorgan Securities Japan Co., Ltd. | 11,969 | 1.00% |

Note: Our treasury stock of 50,856 thousand shares is excluded from the above list.

The shareholding ratios are calculated excluding the number of shares of treasury stock.

No stock split for the past five years.

This Website was created for the purpose of providing information relating to Sojitz corporation. It was not created to solicit investors to buy or sell Sojitz Corporation's stock. The final decision and responsibility for investments rests solely with the user of this Website and its content.

This website contains forward-looking statements about future performance, events or management plans of the Company based on the available information, certain assumptions and expectation at the point of disclosure, of which many are beyond the Company’s control. These are subject to a number of risks, uncertainties and factors, including but not limited to, economic and financial conditions, factors that may affect the level of demand and financial performance of the major industries and customers we serve, interest rate and currency fluctuations, availability and cost of funding, fluctuations in commodity and materials prices, political turmoil in certain countries and regions, litigations claims, change in laws, regulations and tax rules, and other factors. Actual results, performances and achievements may differ materially from those described explicitly or implicitly in the relevant forward-looking statements. The Company has no responsibility for any possible damages arising from the use of information on this website.

Although the information on this website is prepared with the greatest care, the Company does not guarantee the accuracy, continuity or quality of any information provided on this website or that it is up-to-date, nor does it accept responsibility for any damage or loss arising from the falsification of data by third parties, data downloads, etc., irrespective of the reasons therefore.

Please also be aware that information on this Website may be changed, modified, added or removed at any time without prior notice.