Corporate Governance

1. Policy and Basic Approach

1-1. Basic Policy on Corporate Governance

We strive to improve our corporate value over the medium- to-long term based on the Sojitz Group Statement—"The Sojitz Group creates value and prosperity by connecting the world with a spirit of integrity,” as well as Sojitz’s vision for 2030—becoming "a general trading company that constantly cultivates new businesses and human capital.”

In order to materialize this vision, based on our belief that the enhancement of our corporate governance is an important issue of management, we have built the following corporate governance structure in our effort to establish a highly sound, transparent, and effective management structure, while also working toward the fulfillment of our management responsibilities and accountability to our shareholders and other stakeholders.

2. Systems

2-1. Corporate Governance System

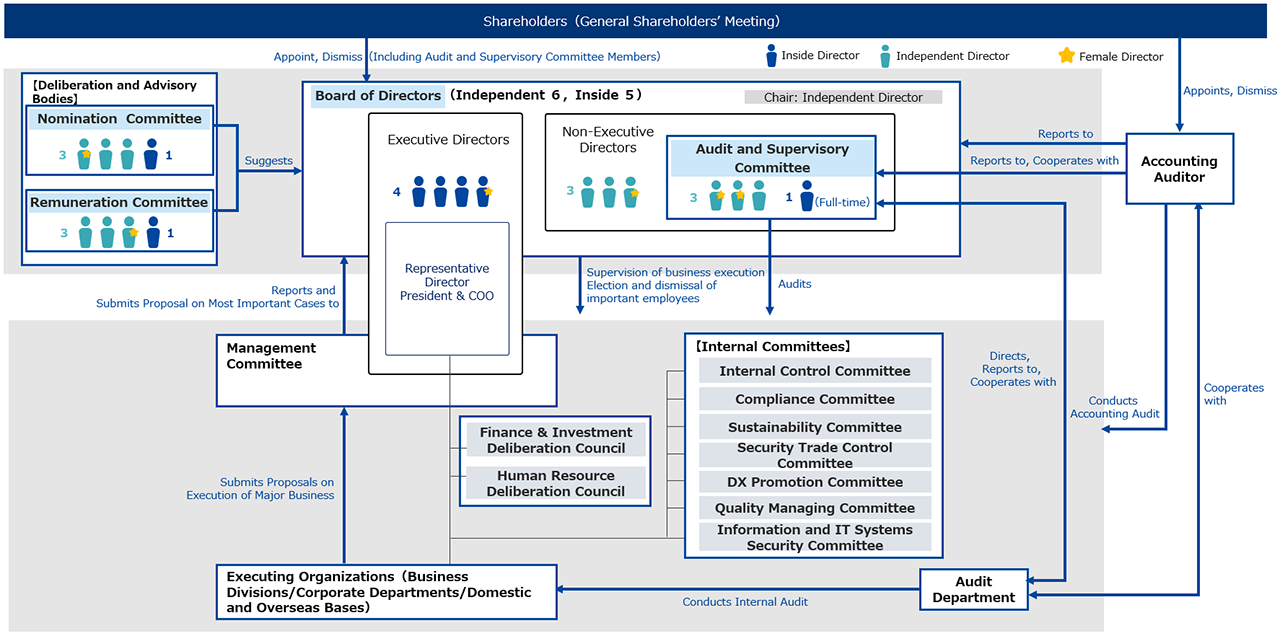

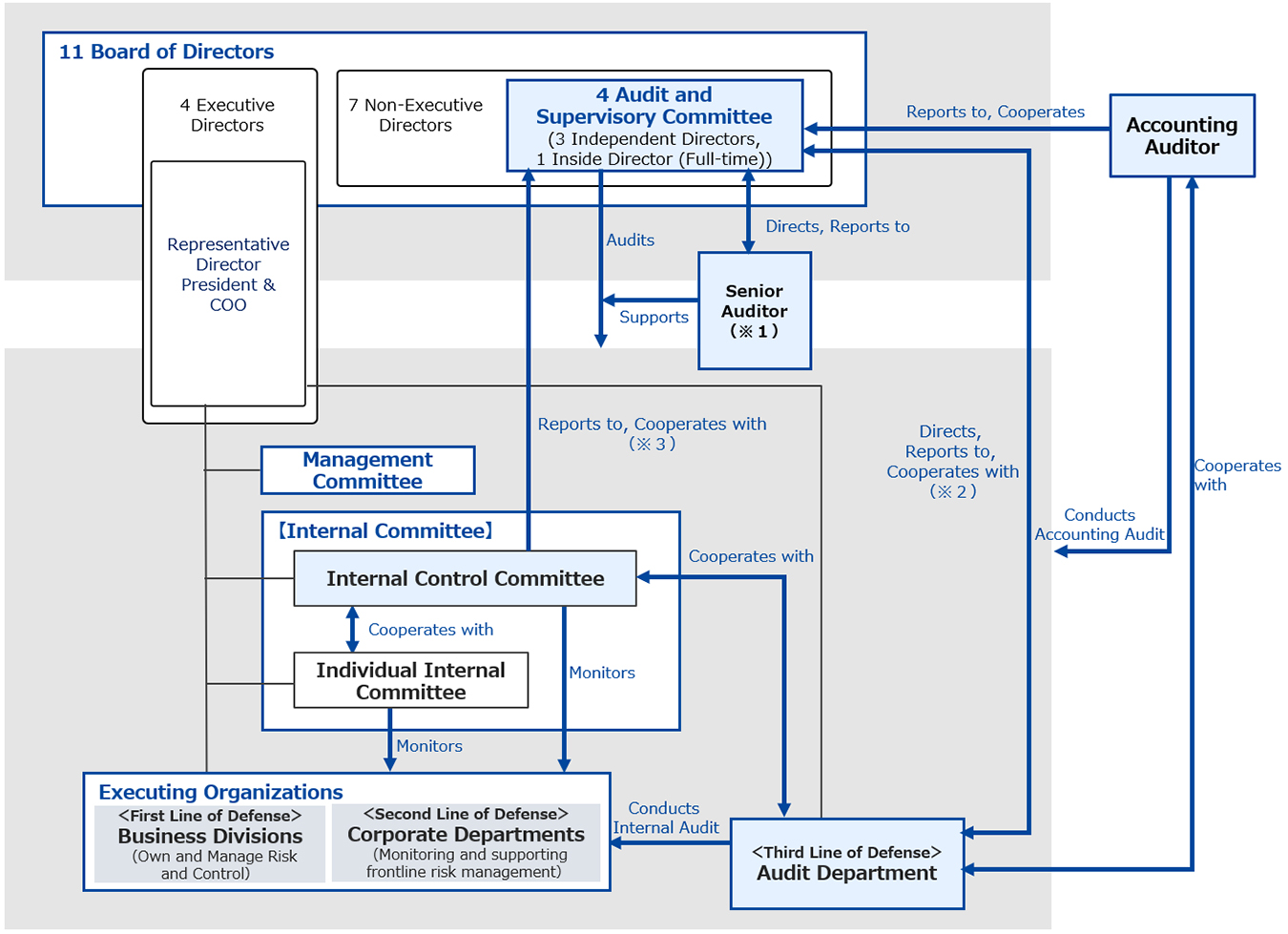

Management and Operation Execution System

We employ an executive officer system for the purpose of clarifying authority and responsibilities and ensuring smooth and swift execution of business through the separation of management supervision and decision-making from operational execution.

The Board of Directors is the highest decision-making body for reviewing and resolving fundamental basic policies and the most important matters concerning the management of the Group. The Board of Directors also supervises operational execution through proposals of important matters and regular reports from the executive function.

The executive function comprises the Management Committee, chaired by the President, who is also the Chief Executive Officer. The Management Committee is responsible for the review and approval of important managerial and executive agendas from a Group-wide and medium- to long-term viewpoint. In addition, we have established the Finance & Investment Deliberation Council for the review and approval of important investments and loans, the Human Resource Deliberation Council for the review and approval of major human resource matters, and internal committees to handle issues to be addressed from cross-organizational perspectives. All of these bodies report directly to the President.

The term of Directors (excluding Directors who are Audit and Supervisory Committee Members) and Executive Officers is set at one year in order to facilitate swift and appropriate responses to rapid changes in the operating environment to clarify responsibilities related to management.

Monitoring and supervisory functions for management

To enhance the Board of Directors’ oversight of business operations and to ensure the receipt of objective and diverse counsel, the majority of the Board of Directors is comprised of Independent Directors, and the Chair of the Board of Directors is an Independent Director.

Sojitz is a Company with Audit and Supervisory Committee. Under this system, Audit and Supervisory Committee Members, the individuals responsible for auditing the execution of duties of Directors, also serve as members of the Board of Directors. This will enable us to reflect audit results in discussions at the Board of Directors meetings, seeking to further strengthen the supervisory function of the Board of Directors.

Furthermore, the majority of the members of the Nomination Committee and the Remuneration Committee, which provide advisory services to the Board of Directors, are Independent Directors, and the Chairs of these committees are Independent Directors, ensuring the appropriateness and transparency of the appointment and remuneration of Directors.

Corporate Governance Framework (as of June 18, 2025)

Overview of Corporate Governance System (as of June 18, 2025)

| Organization Structure | Company with Audit and Supervisory Committee |

|---|---|

| Number of Directors | 11 (6 of whom are Independent Directors) |

| Chair of the Board of Directors | Tsuyoshi Kameoka (Independent Director) |

| Number of Audit and Supervisory Committee Members | 4 (3 of whom are Independent Audit and Supervisory Committee Members) |

| Presence of Executive Officer System | Yes |

| Optional Advisory Committees to the Board of Directors | Nomination Committee and Remuneration Committee |

| Accounting Auditor | KPMG AZSA LLC |

| Corporate Governance Report | https://www2.jpx.co.jp/disc/27680/140120251222523903.pdf We implement all principles established in the Corporate Governance Code. |

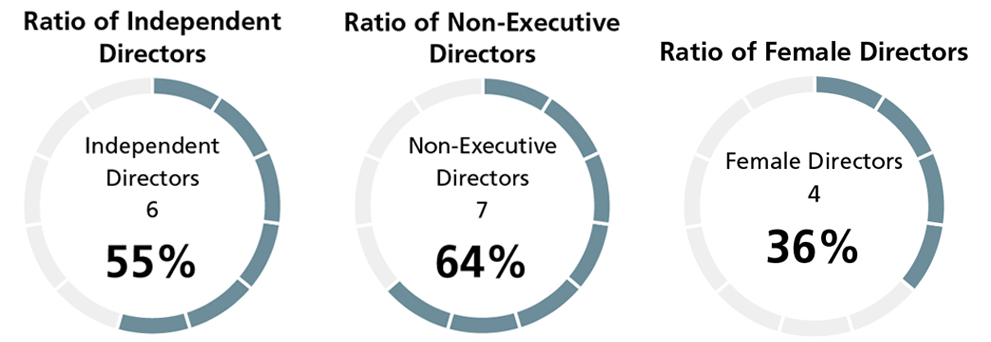

Composition of the Board of Directors

Number of Meetings and Attendance Rate of the Board of Directors and Other Bodies

For FY2024

| Board of Directors | 15 meetings | 100% attendance rate of Directors 100% attendance rate of Audit and Supervisory Board Members (*2) |

|---|---|---|

| Audit and Supervisory Committee | 12 meetings | 100% attendance rate of Audit and Supervisory Committee Members |

| Nomination Committee | 7 meetings | 100% attendance rate of Nomination Committee Members |

| Remuneration Committee | 9 meetings | 100% attendance rate of Remuneration Committee Members |

| Audit and Supervisory Board(*2) | 4 meetings | 100% attendance rate of Audit and Supervisory Board Members |

- Attendance rate is measured as a percentage of the number of meetings held since the appointment of each member.

- We transitioned from a Company with Audit and Supervisory Board to a Company with Audit and Supervisory Committee in June 2024, and the results for FY2024 are shown here.

2-2. The Board of Directors

The Board of Directors

As the highest decision-making body, the Board of Directors reviews and resolves fundamental policies and the most important cases concerning the Group’s management, and also supervises business execution through proposals of important matters and regular reports from the executing body. The Independent Directors supervise the Executive Directors and overall system of business execution. They also provide opinions and advice on corporate governance.

Election Policy of the Board of Directors and Procedure for Appointing Directors

In appointing candidates for Directors, we prioritize diversity and take into consideration gender, age, international experience, and other characteristics, and appoint multiple candidates who possess abundant experience, specialized knowledge, and advanced expertise from both inside and outside Sojitz, to ensure decision-making and management supervision appropriate to a general trading company involved in a wide range of businesses.

In line with the aforementioned policy, the Board of Directors deliberates on the experience and quality as an officer with respect to each Director candidate based on the results of discussion at the Nomination Committee, which provides advisory services to the Board of Directors, and resolves the candidate proposal for submission to the General Shareholders’ Meeting for approval.

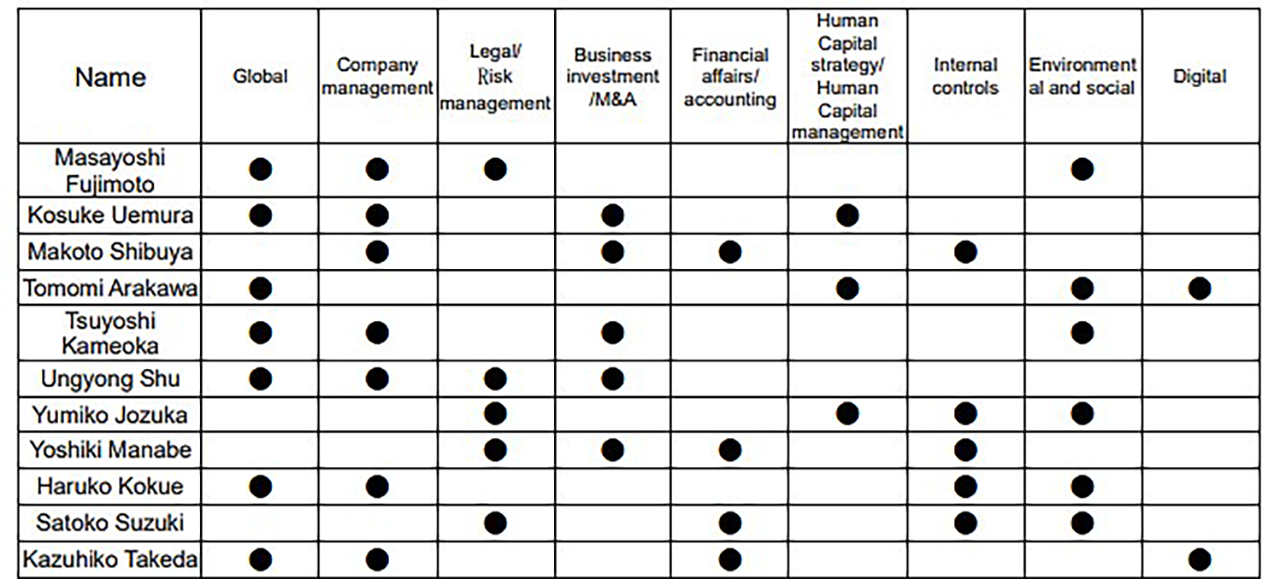

Composition of the Board of Directors

The Board of Directors consists of 11 members (4 women and 7 men). The Board includes 4 Directors who are Audit and Supervisory Committee Members.

- The skills, careers, and expertise required for the Board of Directors will be reviewed in response to changes in the business environment and management policies.

- Areas of particular attention should be paid to by each officer in supervising management are marked with (●).

- For more information on each Director’s career, please click here.

<Purpose of selection of each skill>

| Global | The Company believes that insights related to international circumstances, economics, and culture gained from overseas business management experience are important as we expand diverse businesses globally. |

|---|---|

| Company management | The Company believes that knowledge related to business management and corporate governance gained from management experience at business companies in and outside Japan and overseas operating sites as well as business execution experience at headquarters is important. |

| Legal/Risk management | The Company believes that knowledge to foresee important risks from business execution and oversee whether appropriate contractual practices and risk management are being conducted is important. |

| Business investment/M&A | The Company believes that it is important to have knowledge to make business decisions and supervise business investments and M&A, taking into consideration the management strategy, governance policy, and social/environmental impact. |

| Financial affairs/Accounting | The Company believes that expert knowledge in the fields of financial affairs, accounting, and tax affairs is important for sustainable growth, raising corporate value, and strengthening the financial foundation. |

| Human Capital strategy/Human Capital management | The Company believes that knowledge about sustainable initiatives that strengthen human capital and improve organizational culture is important to become “a general trading company that constantly cultivates new businesses and human capital.” |

| Internal controls | The Company believes that expert knowledge of supervisory, confirmation, and control functions of business execution as well as the ability to supervise the appropriate compliance with laws and regulations, operation, and improvements is important. |

| Environmental and social | The Company aims to generate two values: “value for Sojitz,” which refers to business expansion and sustainable growth, and “value for society,” which refers to regional economic development and environmental conservation. The Company believes that knowledge of international environmental and social issues is important in order to realize them. |

| Digital | Under the banner of “Digital-in-All,” the Company aims to utilize digital technology in all businesses. The Company believes that digital knowledge to oversee “offensive” DX such as transformation and generation of the business model and “defensive” DX such as improved efficiency and strengthening of security is important. |

Matters Deliberated by the Board of Directors

The Board of Directors reviews and resolves fundamental matters concerning the management of Sojitz Group including management policies, plans, and important personnel, systems, and organizational matters. These deliberations are conducted based on relevant laws and regulations, the Articles of Incorporation, and the internal rules of the Board of Directors. The Board of Directors also reviews and resolves important matters related to business execution, such as important investments and loans.

Regarding the execution of business other than these matters resolved by the Board of Directors, the President & CEO and the executing bodies reporting to the President & CEO (namely the Management Committee, the Finance & Investment Deliberation Council, and the Human Resource Deliberation Council) review and approve matters depending on the content, scale, importance, and risks in each case.

In June 2024, the Company transitioned to a Company with Audit and Supervisory Committee. As a result, authority was passed from the Board of Directors to the Executive Directors. Also, in order to ensure effective and efficient debate in the Board of Directors for monitoring purposes, changes were made to systematize the previous report items and merge related proposals.

The Company establishes the annual schedule of the Board of Directors at the beginning of the fiscal year in order to properly ensure deliberation time in the Board of Directors for these important proposals as it takes efforts to standardize the number of proposals and meeting times.

<Main deliberations at the Board of Directors meetings held during FY2024>

| Growth strategy, Investment & Loans | Development and progress report for Medium-Term Management Plan 2026 Acquisition of Australian infrastructure development company, other investments & loans, etc. |

|---|---|

| Financial Results, Performance Progress | Results-related, budget-related, quarterly financial progress reports, etc. |

| Sustainability, Human Capital, Governance | Sustainability initiatives report, progress report on personnel policies, assessment of effectiveness of the Board of Directors, the Board of Directors’ annual plan, Nomination and Remuneration Committees reports, etc. |

| Internal Controls, Audits | Reports on the establishment and operation status of the internal control system (including reports from the Compliance Committee, Security Trade Control Committee, and other various committees), internal audit reports, etc. |

| DX, Systems | DX promotion activities report (status of initiatives for each DX measure, digital Human Capital development, AI governance, etc.), cyberattack response, etc. |

| Others | Executive personnel and remuneration, etc. |

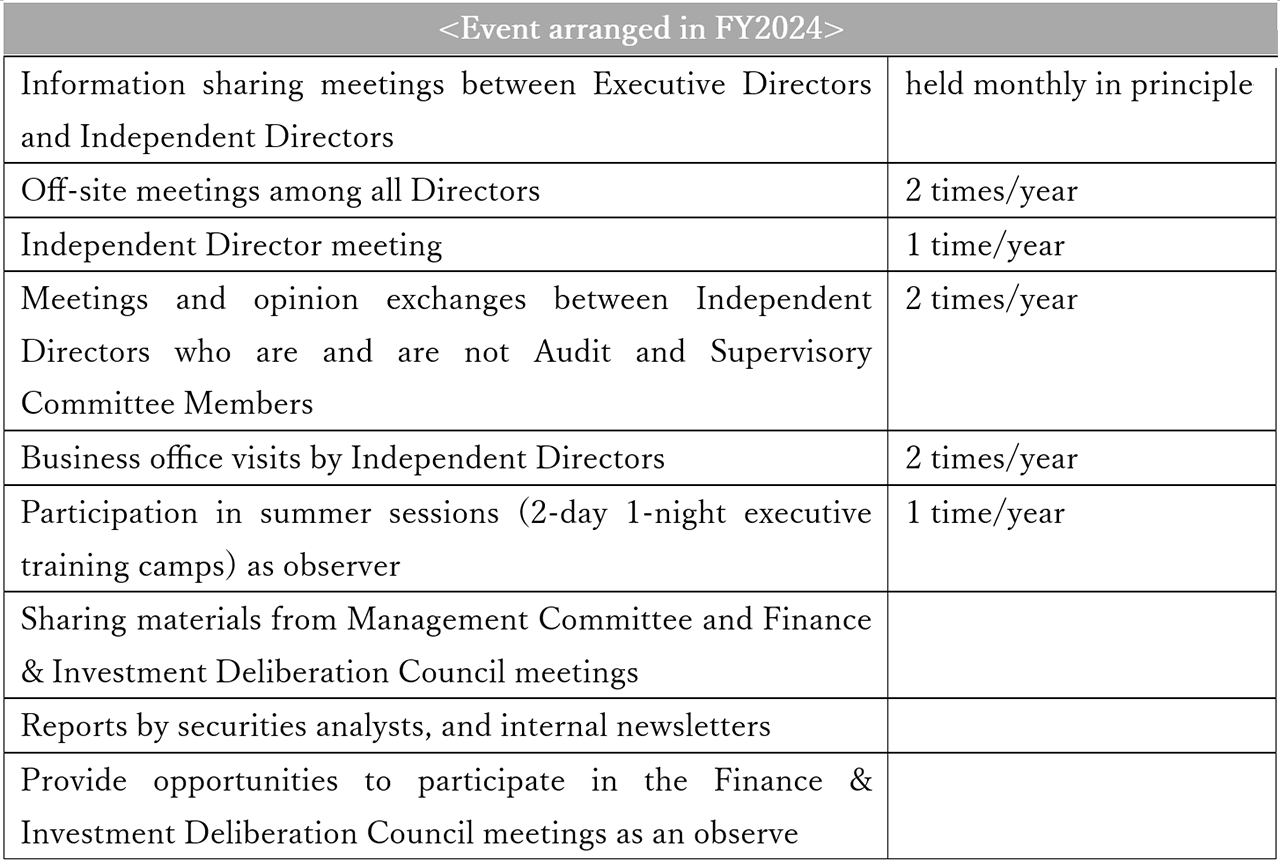

Systems for Supporting and Sharing Information with Independent Directors

We take the following initiatives to enable Directors to appropriately fulfill their roles and responsibilities.

- The Board Meeting Operation Office has been established as an organization which is comprised of five full-time staff (as of the filing date of this report), who support the Directors by reporting to, providing information to, and communicating with Directors in a timely and appropriate manner.

- In order for Directors to deepen their understanding of proposal details, materials are distributed up to five business days before the pre-meeting briefing of the Board of Directors meeting in order to secure sufficient deliberation time. A pre-meeting briefing on proposals will be established up to two business days before the Board of Directors meeting to provide sufficient information about the proposals.

- We provide newly appointed Directors with opportunities to participate in lectures on the medium-term management plan, DX promotion activities, the internal control, risk management structure, IR and sustainability initiatives by each business executing department. In addition, external lawyers also provide lectures about the duties and responsibilities of Directors and Audit and Supervisory Committee Members.

- In order for Directors to deepen their understanding of the latest macroeconomic conditions, our research institute holds monthly briefing sessions. In addition, we provide other necessary information on an ongoing basis.

- We offer Directors opportunities to attend seminars, etc. held by external organizations as needed.

In addition, we establish opportunities to provide and share information with independent Directors as below, to deepen their understanding of the Company businesses, promote communication and mutual understanding between Directors, and facilitate constructive discussions in the Board of Directors meetings.

Analysis/assessment of effectiveness of the Board of Directors

Each year, we analyze and assess the effectiveness of the Board of Directors as a whole in order to improve its functions. In FY2024, upon the transition to a Company with Audit and Supervisory Committee, in order to further enhance the function of the Board of Directors, the Company hired an independent third party (Japan Board Review Co., Ltd.) to conduct an analysis and evaluation.

The method of analysis and the results of the FY2024 assessment, as well as the action plan for the fiscal year 2025 based on these results, are as follows.

1.Assessment method

| Target | All 11 Directors |

|---|---|

| Method of implementation |

|

| Questionnaire items | 1. Medium-to-long-term business issues and risks 2. Board of Directors roles and functions 3. Scale and composition of Board of Directors 4. Operational status of Board of Directors 5. Composition/role and operational status of Nomination Committee 6. Composition/role and operational status of Remuneration Committee 7. Composition/role and operational status of Audit and Supervisory Committee 8. Support system for Independent Directors 9. Response to issues from previous year evaluation 10. Relationship with investors/shareholders 11. Overall effectiveness of governance system and Board of Directors of the Company 12. Self-evaluation |

| Interview items | Interview focused on issues grasped from comments in the additional notes column and points in the questionnaire. |

2.Effective assessment results

The Board of Directors discussed the results of the survey and individual interviews, and confirmed that the effectiveness of the Company’s Board of Directors has been ensured.

(1) Evaluated items

Through the questionnaire and individual interviews, the following points were evaluated highly.

1) Related to transition to a Company with Audit and Supervisory Committee

- The delegation of authority to executive members corresponding to the transition to a Company with Audit and Supervisory Committee reduced the number of proposals and streamlined the report items. This was evaluated highly as it managed to improve the quality of discussion in the Board of Directors and enhance the speed of management decisions.

- The Audit and Supervisory Committee had a smooth start in its first year as it conducted appropriate deliberations through appropriate operation and structure.

2) Scale and composition of Board of Directors

- The Board is an appropriate scale and composition, being comprised of members with a balance from the perspective of the skills matrix.

3) Operations of Board of Directors

- Under the appropriate operation of the Board of Directors meetings (frequency/time of meetings, resolution items, materials, briefings, etc.), executive members properly present and share information.

- Open and lively deliberations are conducted in the Board of Directors meetings. Independent Directors provide opinions and observations from a perspective that contributes to improving corporate value and differs from the discussions of each meeting inside the Company.

- Opinion exchanges in pre-meeting briefings and outside the deliberations are actively held. Therefore, the Board of Directors meeting itself can be held with members fully prepared to discuss proposals.

- Discussion point organization before the Board of Directors meetings and the operation of the discussion on the day of the meeting by the Chair contributes to improving the quality of the Board of Directors discussion.

4) Support system for Independent Directors

- Support system for Independent Directors (pre-meeting briefings, information sharing meetings with Executive Directors, participation as observer in management level training camp summer sessions, business office visits in and outside Japan) is appropriate.

(2) Initiatives and actions taken for FY2024

1) Medium-Term Management Plan 2026

|

|

2) Transition to a Company with Audit and Supervisory Committee

|

<Deliberation by the Board of Directors>

<Response to information gaps among Independent Directors>

|

(3) Initiatives for FY2025

1) Ongoing discussion in the Board of Directors meeting, etc. about the medium-to-long-term strategy and distribution of management resources

- Utilize the time created by reducing the number of resolutions by delegating authority as a result of the transition to a Company with Audit and Supervisory Committee and continuously discuss the medium-to-long term strategy and distribution of management resources in order to achieve the Medium-Term Management Plan 2026 and Next Stage (double growth of corporate value).

- In these discussions, take efforts to provide communication and explanations based on the gap of current status recognition and information between executive members and Independent Directors. Also utilize opportunities outside of deliberations to further enhance discussions.

- Proactively propose and suggest specific themes and discussion points to deepen the discussions at the Board of Directors meetings.

2) Efforts to provide information to Independent Directors in order to enhance supervisory functions

- While maintaining active opinion exchange in pre-meeting briefings and other opportunities outside of the deliberations, take efforts to adjust the agenda setting and the specificity of information and materials provided at the Board of Directors meetings to ensure that such meetings allow for substantial debate from a broad perspective.

- Continue the previous system of information sharing (Independent Director meetings and opinion exchange sessions, etc. of both Independent Directors who are and who are not Audit and Supervisory Committee Members) while aiming to make improvements when necessary, so that Independent Directors can freely share recognition and exchange opinions on matters and issues on the executive side, leading to monitoring discussions at the Board of Directors meetings.

Independent Directors

Policies on Appointment and Standards for Independence of Independent Directors

Sojitz places importance on the independence of Independent Directors. Sojitz has formulated its own Independence Standards for Independent Directors, in addition to the provisions of the Companies Act and standards for independence of officers set by financial instruments exchanges. Sojitz confirms that all our Independent Directors meet these standards.

<Standards Concerning the Appointment of Candidates for Independent Director>

Sojitz appoints Independent Directors from those with a wide range of knowledge, deep insight, excellent character, mental and physical health conditions, and abundant experience in industries and administrative fields, such as those who have management experience in business corporations and government agencies, and who have objective and specialist viewpoints toward world affairs, social and economic trends, and corporate management. Sojitz also ensures the diversity of the candidates’ gender, age, and internationality from the perspective of reflecting the viewpoints of a variety of stakeholders in the supervision of business activities.

<Independence Standards for Independent Directors>

Sojitz judges Independent Directors to be independent by confirming that they do not fall under any of the following conditions, in addition to the independence standards prescribed by financial instruments exchanges.

- A major shareholder of Sojitz (a shareholder holding 10% or more of Sojitz’s total voting rights) or a member of business personnel thereof

- A major creditor to Sojitz (a creditor from whom Sojitz owed an amount exceeding 2% of consolidated total assets in the most recent fiscal year) or a member of business personnel thereof

- A major business partner of Sojitz (a business partner whose transaction amount with Sojitz exceeded 2% of Sojitz’s annual consolidated revenue in the most recent fiscal year) or a member of business personnel thereof

- A party whose major business partner is Sojitz (an entity whose transaction amount with Sojitz exceeded 2% of its annual consolidated revenue, etc. in the most recent fiscal year) or a member of business personnel thereof

- An attorney, certified public accountant, certified tax accountant, consultant or other professional who received money or other property from Sojitz for his/her services as an individual, in an amount exceeding ¥10 million annually on average over the past three fiscal years, other than remuneration of Director or Audit and Supervisory Board Member (if such money or property was received by an organization, such as a corporation or partnership, this item refers to a person who belongs to the organization that received money or other property from Sojitz in an amount exceeding ¥10 million annually on average over the past three fiscal years or in an amount of 2% of the annual gross income or annual consolidated revenue, etc. of the organization, whichever the greater)

- A person who receives donations or grants from Sojitz in an amount exceeding ¥10 million annually (if such donations or grants are received by an organization, such as a corporation or partnership, this item refers to a member of business personnel of the organization)

- A person who serves as Sojitz’s Accounting Auditor or a person who is engaged in auditing Sojitz’s activities as an employee of the Accounting Auditor

- A person who has fallen under any of the above items 1. to 7. in the past three years

- A spouse or relative within the second degree of kinship of a person falling under any of the above items 1. to 8. (limited to the person holding the position of officer or other important positions)

- A spouse or relative within the second degree of kinship of a member of business personnel of Sojitz or any of its consolidated subsidiaries (limited to the person holding the position of officer or other important positions)

- A person with concerns about his/her independence, such as having constant and substantial conflict of interest with general shareholders as a whole in performing the duties of Independent Director

Read more

Advisory Bodies to the Board of Directors (Nomination Committee, Remuneration Committee)

Sojitz has established the following advisory bodies to the Board of Directors.

| Roles | Discusses and proposes the standards and methods for selecting Director and Executive Officer candidates and considers candidate proposals. | Discusses and proposes remuneration levels for Directors and Executive Officers and various systems related to evaluation and remuneration. |

|---|---|---|

| Members* | Independent Directors: 3 Executive Director: 1 |

Independent Directors: 3 Executive Director: 1 |

| Yumiko Jozuka (Chair/Independent Director) Ungyong Shu (Independent Director) Tsuyoshi Kameoka (Independent Director) Kosuke Uemura (Representative Director and President) |

Ungyong Shu (Chair/Independent Director) Tsuyoshi Kameoka (Independent Director) Yumiko Jozuka (Independent Director) Kosuke Uemura (Representative Director and President) |

* As of June 18, 2025

<Activities in FY2024>

| Members | Independent Directors: 3 Executive Director: 1 Chair:Independent Director |

Independent Directors: 3 Executive Director: 1 Chair:Independent Director |

|---|---|---|

| Number of committee members in attendance |

7 times (100% attendance rate of committee members) * |

9 times (100% attendance rate of committee members) * |

| Main deliberations at each committee |

|

|

* Attendance rate is measured as a percentage of the number of meetings held since the appointment of each member.

3. Audit and Supervisory Committee, Accounting Audits, and Internal Audits

Audit and Supervisory Committee

The Audit and Supervisory Committee audits the execution of duties of Directors from the perspective of legality and appropriateness to fulfill its supervisory and auditing functions over operations of business, by attending important meetings related to the execution of business, interviewing Executive Directors, reviewing documents related to important decisions, and using other methods.

Composition of the Audit and Supervisory Committee

The Audit and Supervisory Committee consists of 4 members (2 men and 2 women), including 1 full-time Inside Director and 3 Independent Directors. To ensure the effectiveness of audits by the Audit and Supervisory Committee, we appoint 1 Inside Director who is familiar with the Group’s business as a full-time Audit and Supervisory Committee Member and Chair of the Audit and Supervisory Committee.

Audit System (as of June 18, 2025)

*1 Senior Auditors

- Two Senior Auditors are assigned to ensure the effectiveness of audits by the Audit and Supervisory Committee.

- Senior Auditors are persons who are familiar with the Group’s business and operations and have knowledge of finance and accounting, risk management, and other relevant areas. They complement and support the duties of the Audit and Supervisory Committee from the same perspective as Audit and Supervisory Committee Members.

- The Senior Auditor performs their duties under the direction of the Audit and Supervisory Committee.

- Senior Auditors’ personnel evaluations and transfers are subject to consultation with the Audit and Supervisory Committee to ensure the independence of audits.

*2 Establishment of a reporting line from the Internal Audit Department to the Audit and Supervisory Committee

- The Audit and Supervisory Committee receives regular reports on the audit status from the Internal Audit Department.

- The Audit and Supervisory Committee may ask the Internal Audit Department to make reports and conduct investigations and may give specific instructions to the Internal Audit Department, as necessary.

*3 Establishment of a reporting line from the Internal Control Committee to the Audit and Supervisory Committee

- The Internal Control Committee, which is an executing body under the management of the President, oversees the implementation and enforcement of the internal control system and conducts periodic monitoring. While cooperating with other committees, the Internal Control Committee identifies issues and considers countermeasures related to the internal systems and frameworks, points out these issues to the relevant departments, and makes improvements.

- The Audit and Supervisory Committee receives regular reports from the Internal Control Committee on the establishment and operation status of the internal control system in business execution.

In addition, the Audit and Supervisory Committee, the Internal Audit Department and the Accounting Auditor meet regularly to promote cooperation, share the status of their respective audits, and exchange opinions.

Accounting Audits

Independent auditing firm KPMG AZSA LLC performs accounting audits of Sojitz in accordance with the Companies Act as well as audits of financial statements, and internal control audits in accordance with the Financial Instruments and Exchange Act.

Internal Audits

The Company has established the Internal Audit Department as an organization independent of other business execution departments. The Internal Audit Department (comprising 39 people as of 18 June, 2025) conducts internal audits covering the business divisions, corporate departments, and consolidated subsidiaries to verify that the various management activities and operational controls of the Sojitz Group are being properly executed in compliance with laws, regulations, and internal rules.

The status of internal audits conducted by the Internal Audit Department is as follows:

- The Department develops an annual audit plan with an annual operating policy, priority items, and annual schedule, among other things, and conducts internal audits in accordance with the plan.

- During the audit, the Internal Audit Department investigates whether organizational governance, risk management, and internal controls are functioning appropriately and makes proposals for effective improvements to prevent loss and resolve issues.

- After the audit is completed, the Internal Audit Department convenes an audit review meeting for the audited organization to present the audit results, exchange opinions on problem areas, and discuss improvement measures. Attendees include the president of the audited organization, COOs responsible for corporate departments, and full-time Audit and Supervisory Committee Members. After the audit review meeting, an internal audit report is prepared and submitted to the audit report meeting (comprising Representative Directors, full-time Audit and Supervisory Committee Members, and other persons deemed necessary by the president).

- To address the problems identified in the audits, the Internal Audit Department receives reports about improvements by the audited organizations for the three- and six-month periods after the audits, and conducts a follow-up audit to check their progress.

In addition, the following are initiatives taken by Sojitz to ensure the effectiveness of internal audits.

- The Internal Audit Department’s annual audit plan is determined by the resolution of the Audit and Supervisory Committee and reported to the Management Committee and Board of Directors.

- The Internal Audit Department reports the results of internal audits not only to the Representative Director and President, but also to the Board of Directors and the Audit and Supervisory Committee on a regular basis.

- The General Manager of the Internal Audit Department, full-time Audit and Supervisory Committee Members, and their assistants hold regular meetings to share findings and challenges, among other things, in their respective audit activities in a timely manner and exchange their opinions.

- The Internal Audit Department, Audit and Supervisory Committee, and the Accounting Auditor convene quarterly to share their respective audit results and exchange opinions.

- Deliberations and assessments of the Internal Audit Department’s organizational performance, as well as individual evaluations of the General Manager of the Internal Audit Department, require consultation with the Audit and Supervisory Committee, ensuring the independence of the internal audits.

4. Business Executing Bodies

We have established the following executing bodies that directly report to the President, who is the Chief Executive Officer.

Management Committee

The Management Committee consists of Executive Directors, Chief Operation Officers (COOs) of the business divisions and corporate department supervisors. It reviews and approves management policies, management strategies and management administrative matters among the Group from Group-wide and medium-to-long-term viewpoints.

Finance & Investment Deliberation Council

The Finance & Investment Deliberation Council consists of Executive Directors and corporate department supervisors. It discusses and resolves important investment and loan proposals from a Group-wide viewpoint.

Human Resource Deliberation Council

The Human Resource Deliberation Council consists of Executive Directors and corporate department supervisors. It discusses and resolves important issues pertaining to human resources from a Group-wide viewpoint.

Internal Committees

In order to enhance corporate value, we have established the following internal committees (as of June 18, 2024) that act as executing bodies under the direct supervision of the President to advance management initiatives that need to be handled across the organization.

Internal Control Committee

The Internal Control Committee formulates policies to maintain and improve our internal control system, and monitors this internal control system, its enforcement among the Group, and monitors risks from a Group-wide viewpoint.

Compliance Committee

The Compliance Committee examines and formulates fundamental policies and measures to ensure compliance.

Sustainability Committee

Based on the Sustainability Challenge, the Sustainability Committee examines and formulates various policies and measures, focusing on the realization of a decarbonized society and respect for human rights in the supply chain.

Security Trade Control Committee

The Security Trade Control Committee expedites responses to changing security trade control issues associated with the Sojitz Group and establishes appropriate trade control systems.

Quality Management Committee

The Quality Management Committee builds and maintains a company-wide quality control system and studies and formulates measures to develop business (B to C business) from a market-oriented perspective and to increase corporate value.

DX Promotion Committee

The DX Promotion Committee monitors the overall picture of DX promotion aimed at improving corporate value, and shares the progress and status of efforts, and verifies their effects, with the goal of realizing increased corporate value through business transformation and enhanced competitiveness, while pursuing reforms in business models, human capitals, and operational processes by utilizing digitalization.

Information and IT Systems Security Committee

Information and IT Systems Security Committee promotes task setting, the formulation of action plans, and the implementation of countermeasures relating to the security of company-wide information assets and IT systems to improve corporate value, while grasping the focus and importance of risks that arise in business where digital data and IT are utilized in conjunction with the accelerated promotion of DX.

5. Remuneration of Directors

5-1. Composition of the Executive Remuneration System

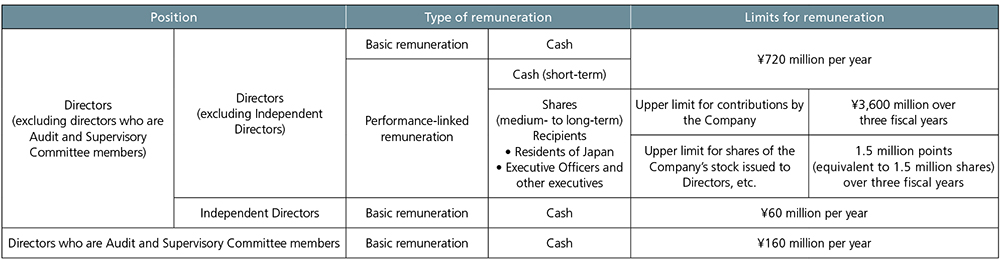

The maximum amount of remuneration of Sojitz’s Directors and other matters were resolved at the Ordinary General Shareholders’ Meeting held on June 18, 2024 as described below.

5-2. Remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members)

As for remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members), the Executive Remuneration Policy, rank-based standard amounts for basic remuneration (fixed remuneration), and calculation methods of performance-linked remuneration (short-term) and performance-linked remuneration (medium- to long-term) (including the targets for each of the evaluation indicators) are decided based on resolutions made by the Board of Directors after deliberations at the Remuneration Committee. Based on these decisions, amounts of remuneration paid to Individual Directors are calculated and determined.

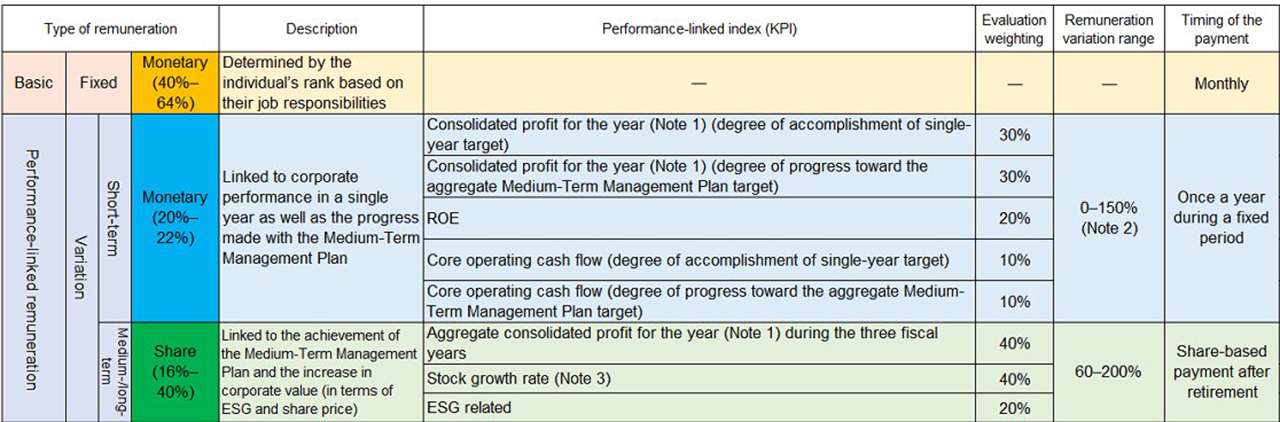

Executive Remuneration Policy

Sojitz’s basic policy on remuneration for Directors is to create a system that is closely linked to the Company business performance and that will ensure transparency and objectivity with the aim of raising the motivation of Directors to contribute to improved performance and corporate value over the medium to long term. In accordance with this basic policy on remuneration, the Executive Remuneration Policy (Company policy for determining amounts of remuneration paid to individual Directors, etc.) was approved at the Board of Directors meeting held on March 22, 2024 in order to make a policy for the remuneration of Directors and Executive Officers that is consistent with Sojitz’s corporate statement, value creation model, Vision for 2030, and Medium-Term Management Plan 2026, which was launched in April 2024. The details of the Executive Remuneration Policy are as follows.

| Basic view | Sojitz’s basic view on remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members; the same applies hereinafter) and Executive Officers (hereinafter collectively referred to as the “Officers”) is based on the following two considerations.

|

||||||

|---|---|---|---|---|---|---|---|

| Basic policies |

|

||||||

| Breakdown of remuneration | ◆Level of remuneration In line with the basic policies, Sojitz will provide an attractive level of remuneration commensurate with the job responsibilities of each of the Officers. The level of remuneration shall be determined in consideration of factors such as remuneration offered by other general trading companies, surveys conducted by third parties on executive remuneration at listed corporations in Japan, along with the level of employee salary. The level of Sojitz’s executive remuneration shall be subject to review as appropriate depending on the changes in the external business environment. ◆Structure of remuneration Sojitz’s remuneration consists primarily of basic remuneration and performance-linked remuneration. Medium- to long-term performance-linked remuneration applies a “pay for mission” approach, which takes into consideration factors such as the fulfillment of our corporate statement and the creation and provision of the two types of value. - Basic remuneration (Fixed remuneration) :Monetary remuneration determined by the individual’s rank, commensurate with job responsibilities - Performance-linked remuneration (short-term) :Monetary remuneration linked to corporate performance in a single year as well as the progress made with the medium-term management plan - Performance-linked remuneration (medium to long-term) :Share remuneration linked to the achievement of the medium-term management plan and the increase in corporate value (in terms of ESG and share price) * ◆Remuneration mix [Officers (excluding Independent Directors)] The proportion of basic remuneration among total compensation will be lowered to between approximately 40% and 64%, based on job responsibilities, and the proportion of performance-linked remuneration will be raised.

[Independent Directors (excluding Directors who are Audit and Supervisory Committee Members)] Remuneration consists wholly of basic remuneration, while special allowance shall be paid separately to the Chairperson of the Board of Directors, and the Chairs of the Nomination Committee and the Remuneration Committee. ◆Timing of the payment of remuneration - Basic remuneration: Paid monthly - Performance-linked remuneration (short-term): Paid once a year at a certain time - Performance-linked remuneration (medium-to long-term): After retirement* |

||||||

| Determination method of performance-linked remuneration |

Determined based on factors such as the degree of accomplishment of targets, progress made with the medium-term management plan and individual contribution to corporate performance. | ||||||

| Forfeiture of remuneration (claw back clause, malus clause) |

If a resolution is passed by the Board of Directors for a post -closing correction of accounts due to serious accounting errors or fraud, or if wrongdoing by an Officer is confirmed by the Board of Directors, Sojitz may restrict the payment of performance-linked remuneration or request the refund of the remuneration the Officer has received. | ||||||

| Governance over remuneration | The amount of remuneration for each of the Officers shall be determined by the Board of Directors, after deliberations at the Remuneration Committee chaired by an Independent Director, with the majority of committee members being Independent Directors. The amount of remuneration for Directors who are Audit and Supervisory Committee Members shall be determined through discussion among the Directors who are Audit and Supervisory Committee Members. |

- * For share remuneration, after retirement of Directors, based on the confirmation that they meet the beneficiary requirements, they shall receive delivery of the number of Sojitz shares equivalent to the accumulated share delivery points calculated at the rate of one Sojitz share per share delivery point. The beneficiary requirements shall be determined as necessary to achieve the purpose of the share remuneration system.

Composition of Remuneration

With the aim of further enhancing the link between remuneration and business performance and creating a remuneration system that includes a system of evaluation criteria that more fully reflects the efforts and progress made toward improving corporate value in the medium- to long-term, Sojitz has decided to lower the proportion of basic remuneration among total compensation for Directors (excluding Independent Directors and Directors who are Audit and Supervisory Committee Members) and Executive Officers to between approximately 40% and 64%, based on their job responsibilities, and raise the proportion of performance-linked remuneration from the year ending March 31, 2025.

In order to ensure that the executive remuneration system is closely linked to Sojitz’s corporate performance and is highly transparent and objective, the target of each indicator was determined by resolution of the Board of Directors after deliberations at the Remuneration Committee, reflecting the targets set out in Medium-term Management Plan 2026.

(excluding Independent Directors and Directors who are Audit and Supervisory Committee Members)>

(Notes)

- Refers to profit for the year attributable to owners of the company.

- If actual results for each criterion fall below 40% of the targets, no remuneration shall be paid for such criterion.

- Evaluation shall be made based on a relative comparison between total shareholder return (TSR) of Sojitz and dividend-included TOPIX.

- Level of achievement of the ESG targets is evaluated by the Remuneration Committee.

Remuneration System of Directors and Method of Calculation for Remuneration in the Year Ending March 31, 2026

For more information on the remuneration of Directors and the Method of calculation for performance-linked remuneration (short-term / medium- to long-term) in the year ending March 31, 2025 utilized in accordance with the Executive Remuneration Policy, please refer to here.

5-3. Remuneration System of Directors who are Audit and Supervisory Committee Members

Performance-linked remuneration is not paid to Audit and Supervisory Committee Members out of consideration for their role in auditing Directors’ execution of their duties. As a result, Audit and Supervisory Committee Members only receive basic remuneration (monetary). The amount of such remuneration is determined through discussion among the Directors who are Audit and Supervisory Committee Members.

5-4. Remuneration of Directors and Audit and Supervisory Board Members for the Year Ending March 31, 2025

Total amount of remuneration by officer classification, total amount of remuneration by type of remuneration and number of company officers subject to payment

(Millions of Yen)

| Person to be paid | Basic remuneration | Performance-linked remuneration | Total | ||

|---|---|---|---|---|---|

| Monetary (*1, 2) |

Monetary (short-term) (*1) |

Share (medium-to long-term)

(*1, 3, 4) |

|||

| Directors (Total) | 11 | 317 | 135 | 223 | 676 |

| (of which, Independent Directors) | (5) | (50) | - | - | (50) |

| Audit and Supervisory Board Members (Total) | 5 | 26 | - | - | 26 |

| (of which, Independent Audit and Supervisory Board Members) | (3) | (8) | - | - | (8) |

| Directors who are Audit and Supervisory Committee Members (Total) | 4 | 75 | - | - | 75 |

| (of which, Independent Directors) | (3) | (35) | - | - | (35) |

- Figures are rounded down to the nearest million yen.

- Based on the resolution of the 21st Ordinary General Shareholders’ Meeting held on June 18, 2024, Sojitz transitioned to a Company with Audit and Supervisory Committee, effective on the same date. As of the end of FY2024, there were 7 Directors and 4 Directors who are Audit and Supervisory Committee Members. The total amount of remuneration of Directors includes that for 2 Directors who retired due to expiration of their term of office at the conclusion of the Ordinary General Shareholders’ Meeting held on June 18, 2024 and the remuneration for the period before the transition to a Company with Audit and Supervisory Committee for 2 Directors who were newly appointed as Directors who are Audit and Supervisory Committee Members. The amount of remuneration for Audit and Supervisory Board Members includes the remuneration for the period before the transition to a Company with Audit and Supervisory Committee.

- Regardless of whether before or after the transition to a Company with Audit and Supervisory Committee, as the Board of Directors confirmed that the amounts of remuneration for individual Directors for FY2024, including the target of each evaluation indicator, based on the Executive Remuneration Policy, basic remuneration (fixed remuneration) by rank, the calculation method for performance-linked remuneration (short-term), and the calculation method for performance-linked remuneration (medium- to long-term) were consistent with the determination policy described in below, the details of such remuneration were judged to be in line with the policy.

- The performance-linked remuneration (medium- to long-term) is a share remuneration system based on the Board Incentive Plan (BIP) Trust. The total amount of the aforementioned share remuneration represents the amount reported as expenses for FY2024 associated with the share delivery points regarding the BIP Trust, including the persons who are scheduled to retire in FY2024.

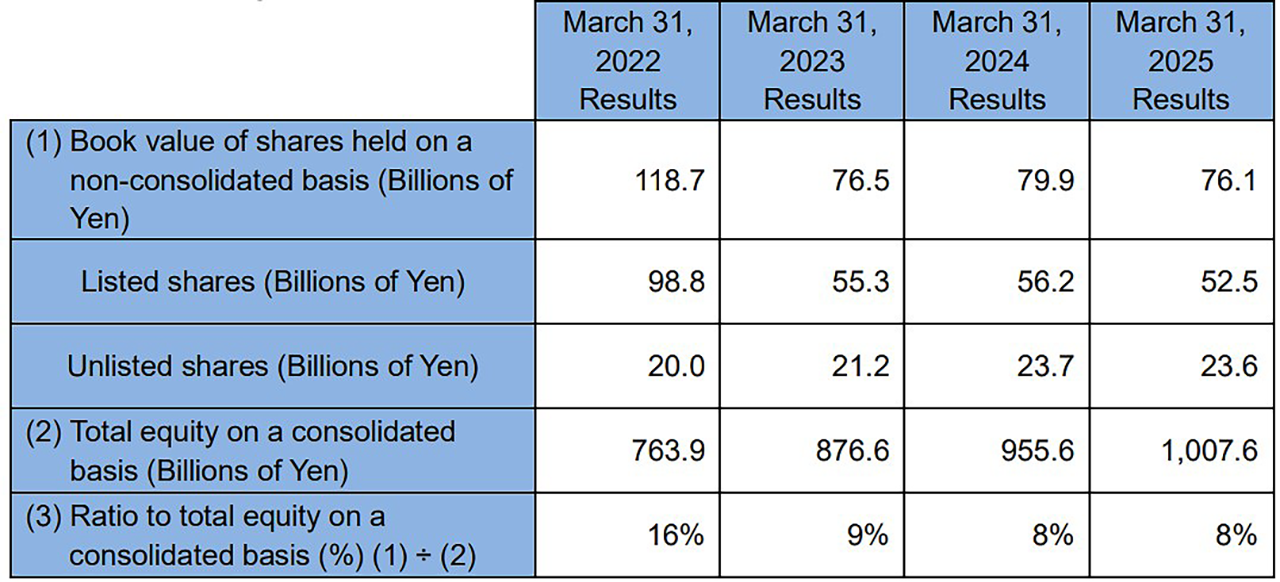

6. Holdings of Listed Shares

6-1. Policies for Shareholdings under Medium-term Management Plan 2026

Each year, we conduct a quantitative assessment of each lot of listed shares that we continue to hold as cross-shareholdings to ensure that dividends or related profit earned from those shares exceed the shares’ equity cost (weighted average cost of capital). We also conduct a qualitative assessment, looking at whether the shares help improve our corporate value. Based on these assessments, we examine the value of retaining these holdings. We retain those holdings that are deemed to be worthwhile, seeking ways to achieve greater impact and benefit from those shares. Meanwhile, for those shares which are deemed to lack significant value, we set a deadline to improve their value, or, if there is no indication these shares will improve, we examine the possibility of divestiture. The Board of Directors and the Management Committee conduct such assessments for each lot of shares held as cross-shareholdings.

* The figures for listed shares reflect share prices at each point in time.

6-2. Exercise of Voting Rights

Based on the significance of holding shares of listed companies, we exercise our voting rights based on whether or not they contribute to sustainable growth and improved corporate value over the medium- to long-term for both Sojitz and the investee. We also have a system of monitoring the status of exercise of voting rights.