Complying with TCFD

Sojitz Group is actively working to disclose information and improve transparency by utilizing the TCFD*1 framework regarding risks and opportunities related to climate change.

- In August 2018, Sojitz declared its endorsement of the final recommendations of the TCFD (Task Force on Climate-related Financial Disclosures).

Status of initiatives according to the TCFD framework

Governance

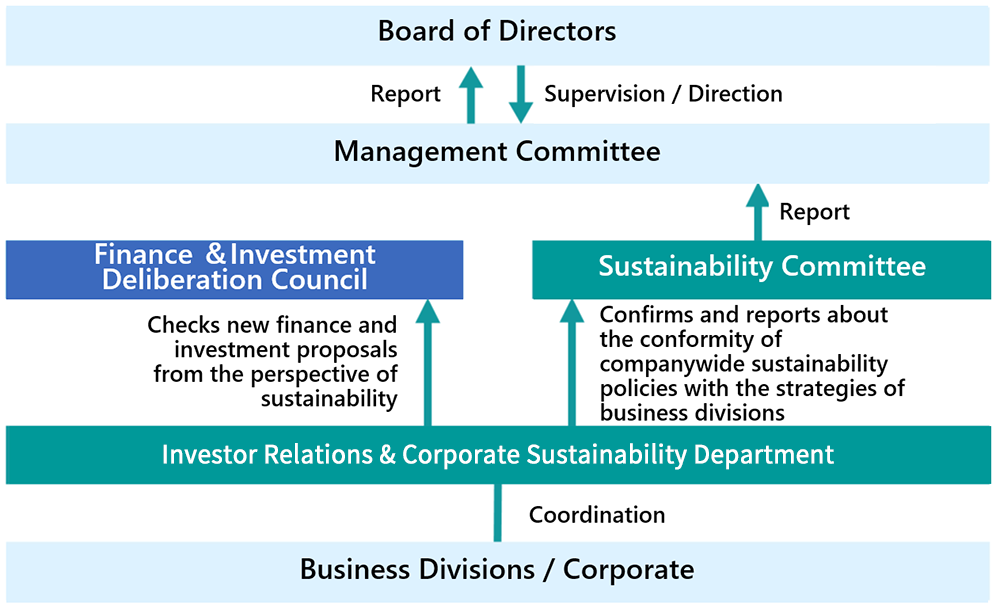

The Sustainability Committee, chaired by the President & COO, meets at least four times a year. Policies, issues, and other matters discussed by the Sustainability Committee are brought up for deliberation or are reported to the Management Committee and the Board of Directors. The Board of Directors supervises this process and gives directives as necessary.

Risk Management

The Sustainability Committee evaluates and identifies CO2 emissions risks in each business conducted by Sojitz Group.

In addition, Sojitz confirms individual business risks as part of the deliberation process of the Finance & Investment Deliberation Council and shares this information with each business division through the Management Committee. Furthermore, Sojitz holds stakeholder dialogues to discuss and confirm the impact of climate-related risks and opportunities on our businesses.

Strategy

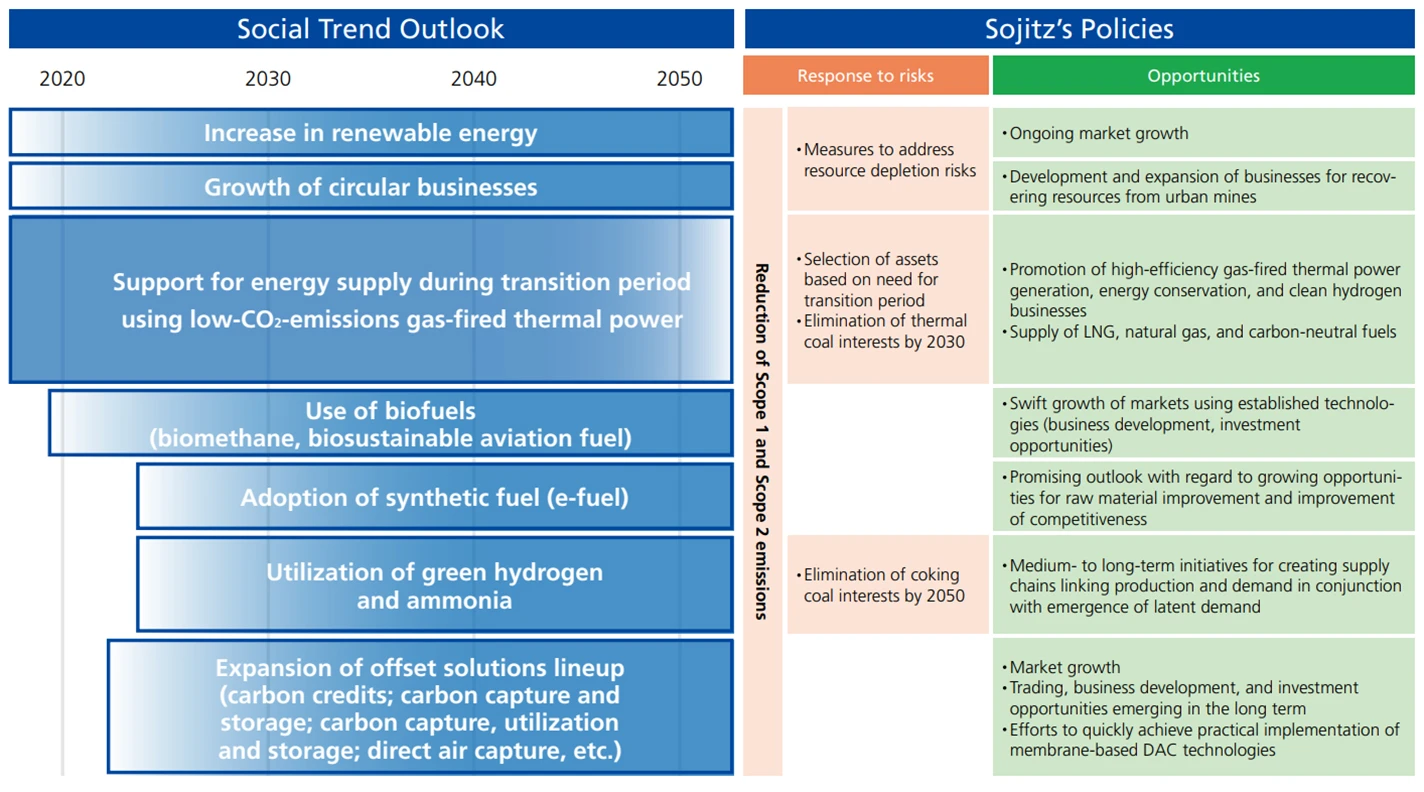

【Formulating Sojitz’s actions and approach based on anticipated technological trends for each decade】

Sojitz identifies the technological and global trends of each decade and organizes its thinking and policies based on risks and opportunities for Sojitz. Sojitz will continue to monitor external trends and update its approach and ways of thinking.

Transition Risks

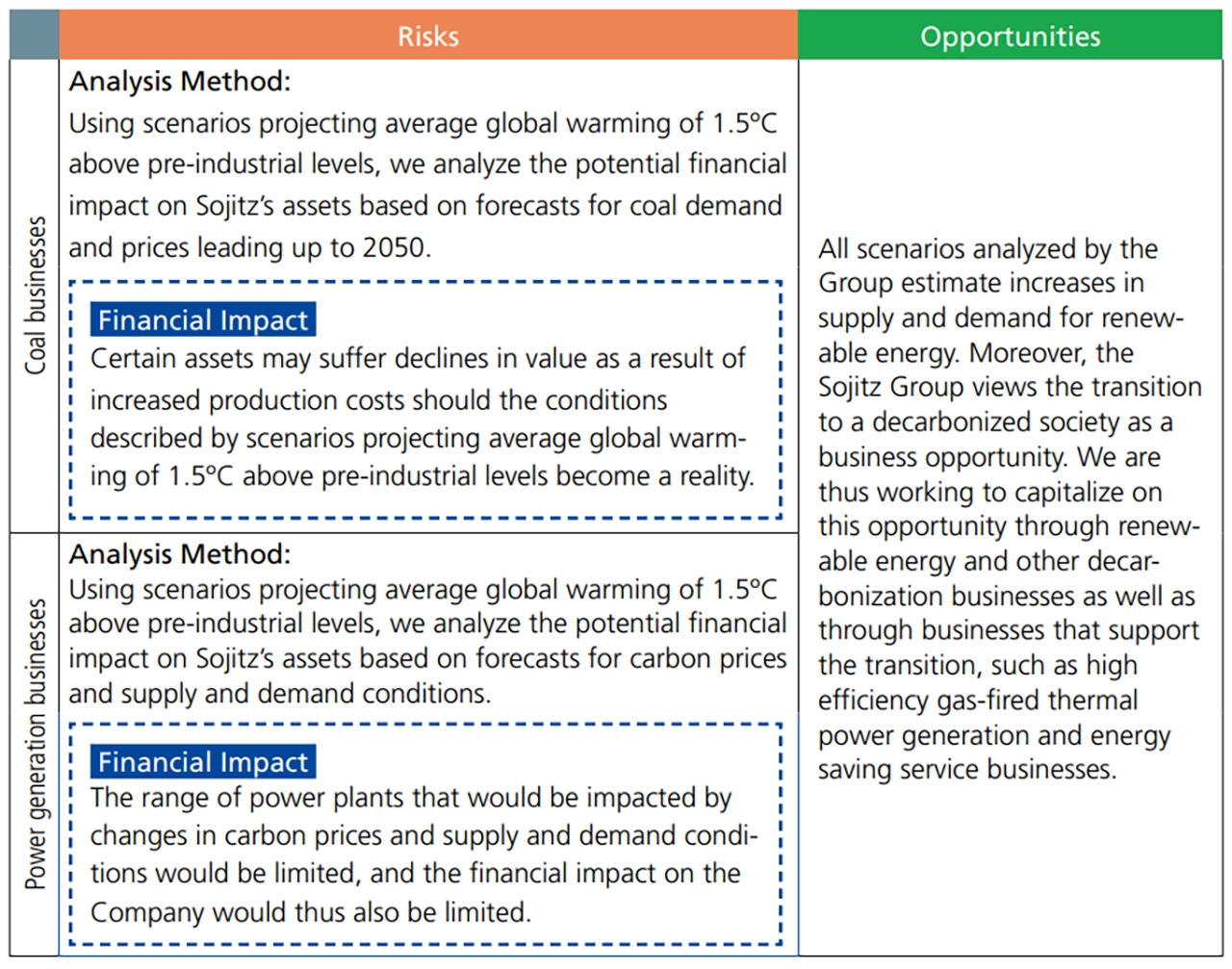

【Conducting scenario analysis of future risks and opportunities】

Based on external investigations and internal analysis, we are working on sequential scenario analysis of the business fields believed to present the greatest risks and opportunities to our Group’s business activities, management strategy, and financial planning. The scenario analysis is then analyzed to determine financial impact.

In addition, we will further strengthen our efforts in the area of circular economy, which is essential for achieving a decarbonized society.

Physical Risks

In addition to preparing for transition risks, we are also planning ways to address physical risks in the event that climate change cannot be curbed and global warming continues to progress. To begin with, we are examining the risks to our assets, primarily focusing on water-related risks such as floods and droughts.

Sojitz conducts regular surveys to confirm impacts on Sojitz’s businesses by utilizing the Aqueduct analysis tool for water risk assessment that references the 4-degree scenario (RCP8.5) provided by the World Resources Institute.Under Medium-term Management Plan 2023, Sojitz addressed physical risks classified by the TCFD framework and measured the financial impacts for company assets identified as having potential flood-related risk, which was considered an acute physical risk.

Amount of damages to company assets (tangible fixed assets) in the event of a flood: JPY 29 billion

- Tangible fixed assets in the “Extremely High” and “High” category in the Aqueduct analysis tool as of end of March 2024.

Metrics and Targets

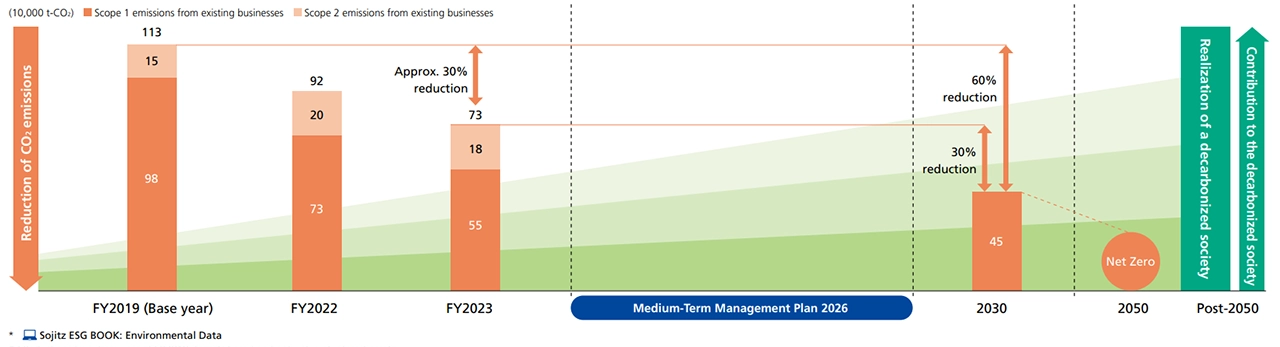

Sojitz’s Decarbonization Roadmap

● We have set policies and targets for existing and new businesses moving forward. For existing businesses, we have set CO2 reduction targets according to the international standards for CO2 emissions (SCOPE). For new businesses, we see the transition to a decarbonized society as an opportunity and will actively promote this transition while tailoring our approach in each business to achieving net-zero emissions.

● Sojitz Group's Policies for Realizing a Decarbonized Society (established in March 2021) Click for details

Existing businesses

[Scope 1 and Scope 2 Targets]

Scope 1 encompasses all of the CO2 generated directly by the company from burning resources such as gas. Scope 2 mainly refers to the CO2 generated by the company’s consumption of electricity. Both Scope 1 and Scope 2 emissions are direct emissions attributable to the company’s energy use, and Sojitz Group emits roughly 1 million tons of CO2 annually. Although Scope 1 and Scope 2 emissions are limited compared to our indirect emissions from natural resource interests (Scope 3), we believe that decarbonization is necessary for strengthening the resilience of our revenue base and therefore aim to achieve the following decarbonization targets.

| SCOPE1+2 |

Reduce emissions 60% by 2030; achieve net-zero emissions by 2050 *1 For Scope 2: Net-zero emissions by 2030 *2 |

|---|---|

| Coal-fired power generation | No current projects nor future projects planned |

*1, *2

Reductions from base year of FY2019, scope includes Sojitz Corporation (non-consolidated), consolidated subsidiaries, and unincorporated joint ventures subject to reporting based on Sojitz approach toward control of management

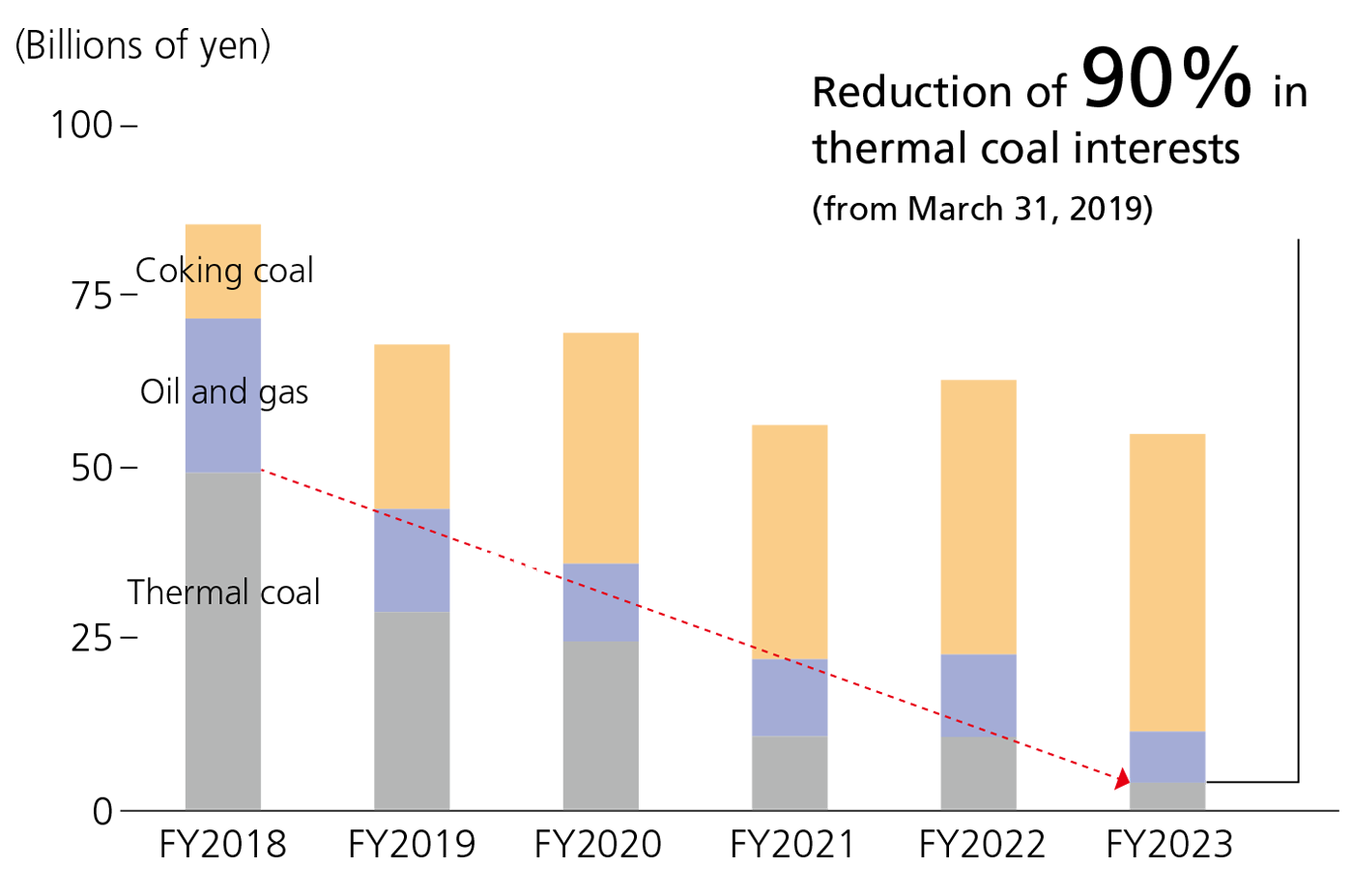

[Scope 3 Targets (Natural Resource Interests)]

| Thermal coal interests |

Reduce interests to half or less by 2025 zero interests by 2030 *3 |

|---|---|

| Oil interests | Zero interests by 2030 |

| Coking coal interests | Zero interests by 2050 |

- *3 FY2018 serves as the base year, and targets are based on the book value of assets in coal interests. Sojitz has achieved its goal announced in May 2019 of reducing thermal coal interests to half or less by 2030 ahead of schedule.

【New business】

We have adjusted our approach to decarbonization for each business and aim to achieve net zero CO2 emissions by 2050.

【Contributing to a decarbonized society】

- Sojitz considers this an opportunity and will expand related businesses and promote decarbonization initiatives.

- Sojitz will measure the amount of avoided CO2 emissions from environmentally friendly products and services (Scope 4) prior to pursuing business.

What is TCFD?

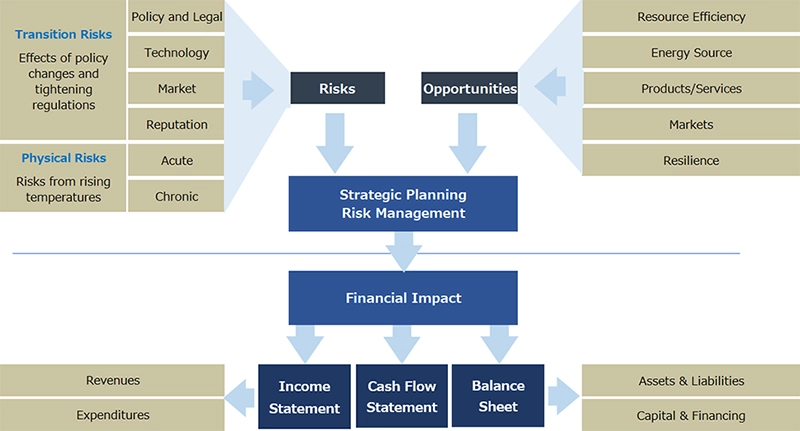

TCFD stands for Task Force on Climate-related Financial Disclosures. The TCFD is an initiative created by the Financial Stability Board (FSB) based on the request from the G20 seeking a review of the financial industry from the perspective of financial stability and preventing loss of assets as the financial world undergoes fundamental and serious changes in transition to a low-carbon economy.

TCFD encourages companies to assess and consider future financial effects that result from the risks and opportunities presented by climate change.

TCFD-recommended Framework for Climate-related Financial Disclosures

TCFD presents a voluntary framework for helping businesses disclose climate-related financial information. The TCFD recommends disclosure in relation to risks and opportunities linked to climate change in terms of four themes:governance, strategy, risk management, and metrics and targets.

Additionally, it recommends incorporating climate-related scenario analysis as a distinctive part of strategic planning.

Governance

- Ensure oversight by the Board of Directors

- Define the role of management in assessing and managing risks and opportunities

Risk Management

- Describe the processes for identifying and assessing risks

- Describe the processes for managing risks

- Integrate those processes into overall risk management

Strategy

- Identify the climate-related risks and opportunities over the short, medium, and long term

- Describe the impact on the company's businesses, strategy, and financial planning

- Incorporate scenario analysis in strategic planning

Metrics and Targets

- Set targets for evaluating risk

- Disclose greenhouse gas emissions and the related risks

- Describe the targets and relevant Key Performance Indicators to manage risks