Medium-term Management Plan

General Policy

Positioning of MTP2026 - Set for Next Stage

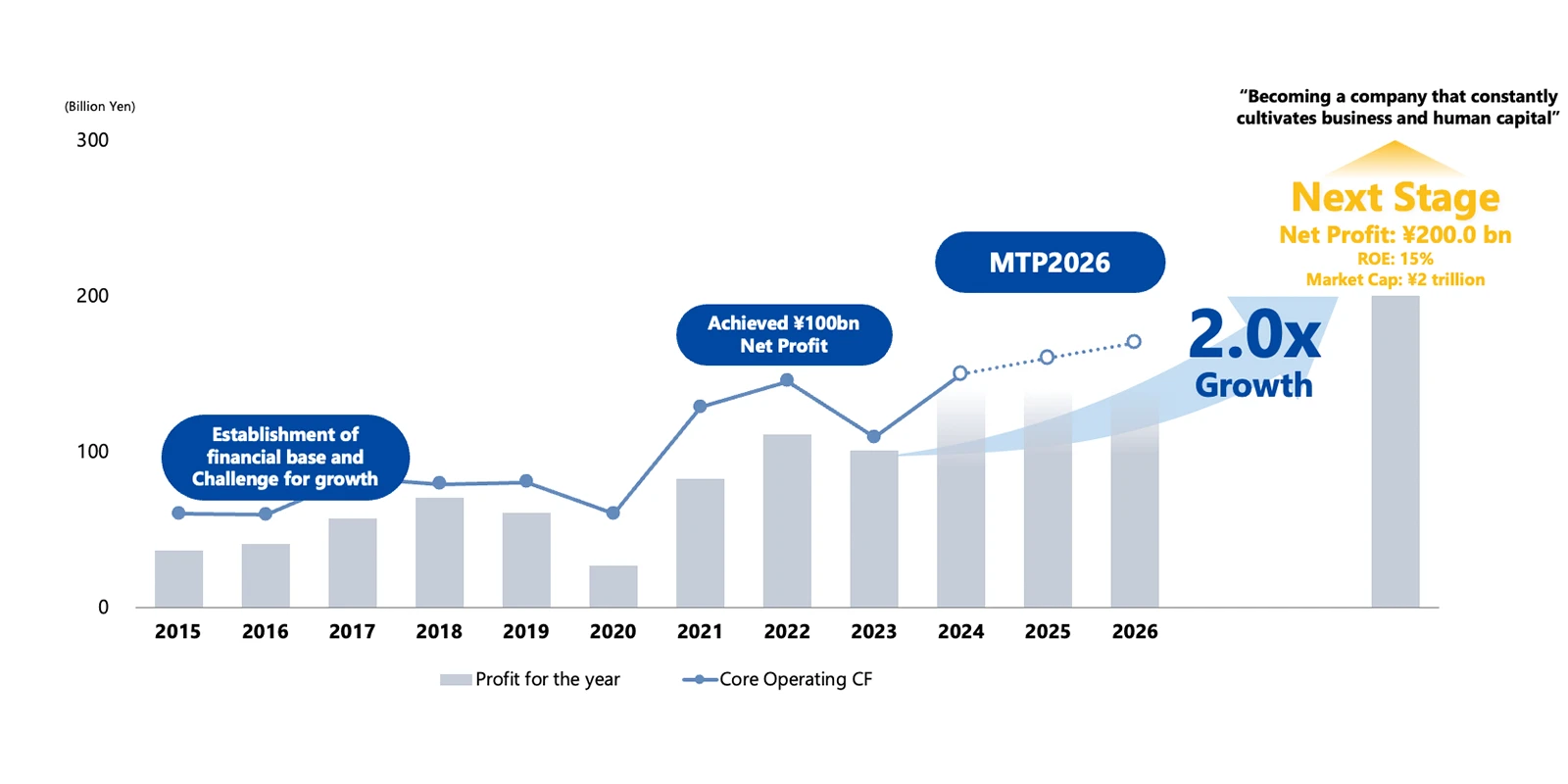

Profitability has steadily improved, except during the COVID-19 pandemic period. We have enhanced our value creation and value-up capabilities and are making new investments to drive further growth.

We will concretize our target destination as Next Stage, and position Medium-term Management Plan 2026 to establish and strengthen our business foundation. We will strengthen businesses and form multiple attractive "Katamari (revenue-generating clusters of businesses)" that embody Sojitz’s unique identity.

To realize Sojitz Growth Story and reach Next Stage, we will actively invest in our growth foundation and human capital.

Roadmap to the “Next Stage”

MTP

2023

- Start of the Next Decade -

Transformation of business portfolio for sustainable value creation, and

challenges for “New way and New value”

Continuing

growth

MTP

2026

Creating the “Sojitz Growth Story”

- Set for Next Stage -

To reach Next Stage (Market cap “2.0x Growth”),

Connect dots of our businesses to form “Katamari ”* to accelerate growth

Proactive investments in and development of human capital

Reinforcing

Base of

Growth

EnhancingHuman

Capital

* “Katamari” is the Japanese word for business cluster. In this context, it refers to a business (or business cluster) generating a significant profit. Sojitz aims to form many “ Katamari ”, each of which comprises a large portion of the Sojitz Group portfolio.

Next

Stage

Net profit: ¥200.0bn

ROE: 15%

Market cap: ¥2 trillion

Vision for 2030

“Becoming a company that constantly cultivates business and human capital”

Create our corporate value by meeting market needs and

providing solutions to social issues

Sojitz Group Statement

The Sojitz Group creates

value and prosperity by

connecting the world

with a spirit of integrity.

-

The Progress of Sojitz Growth Story:

Presentation Material

[PDF:2.03 MB]

Quantitative Targets

-

Investment and

Financial Disciplinewith maintaining

financial discipline>¥600.0bn

Investment plan -

Financial Targets

(3 years avg.)ROE >12%

Net Profit

>120.0bn -

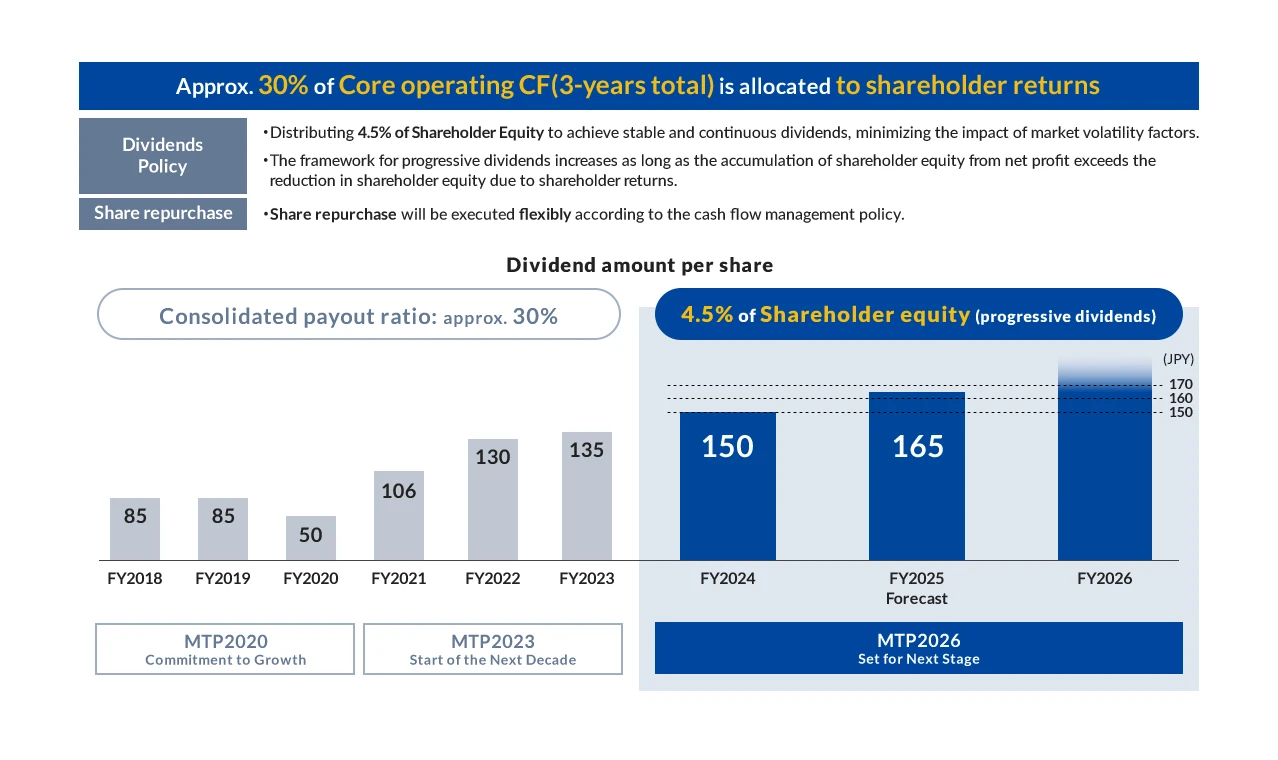

Shareholder Returns

approx.30%of

Core operating CF (3 years total)

is allocated to shareholder returnsProgressive dividend

4.5% of Shareholder equityFlexible Share repurchase

in case of surplus cash flow

Basic Strategy

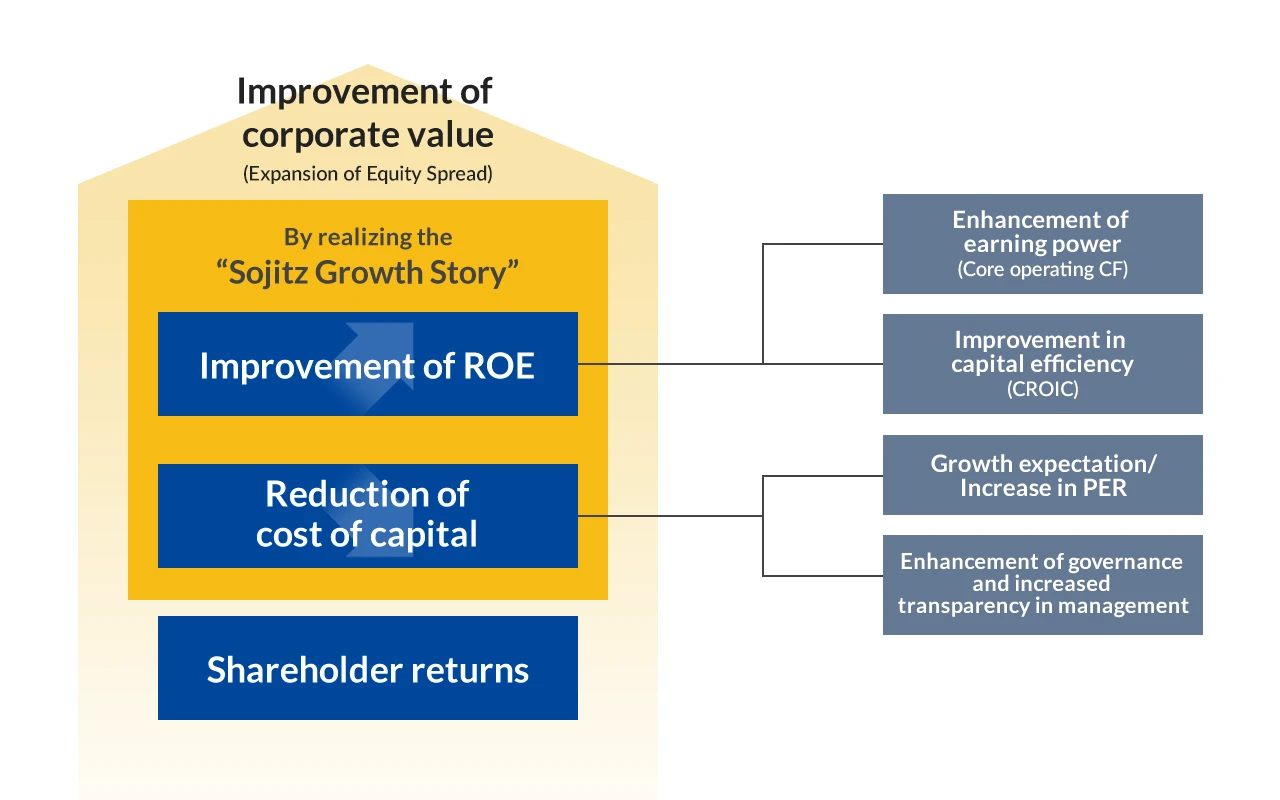

Improvement of Corporate Value

Continuing MTP2026 to commit to improve our corporate value with aim to increase PER by realizing the “Sojitz Growth Story”.

Consequently, PBR will be consistently be maintained above 1.0x and further improvement will be achieved.

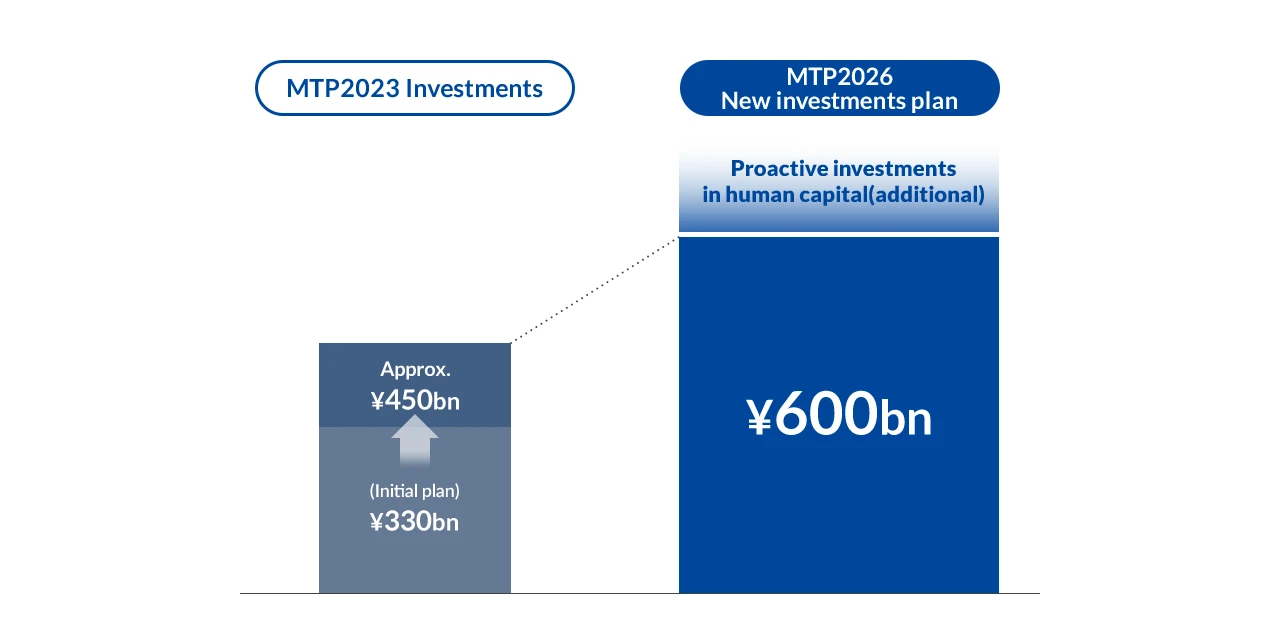

Strategy for New Investments

Make aggressive growth investments (¥600bn) and additional investments in human capital to reach the Next Stage.

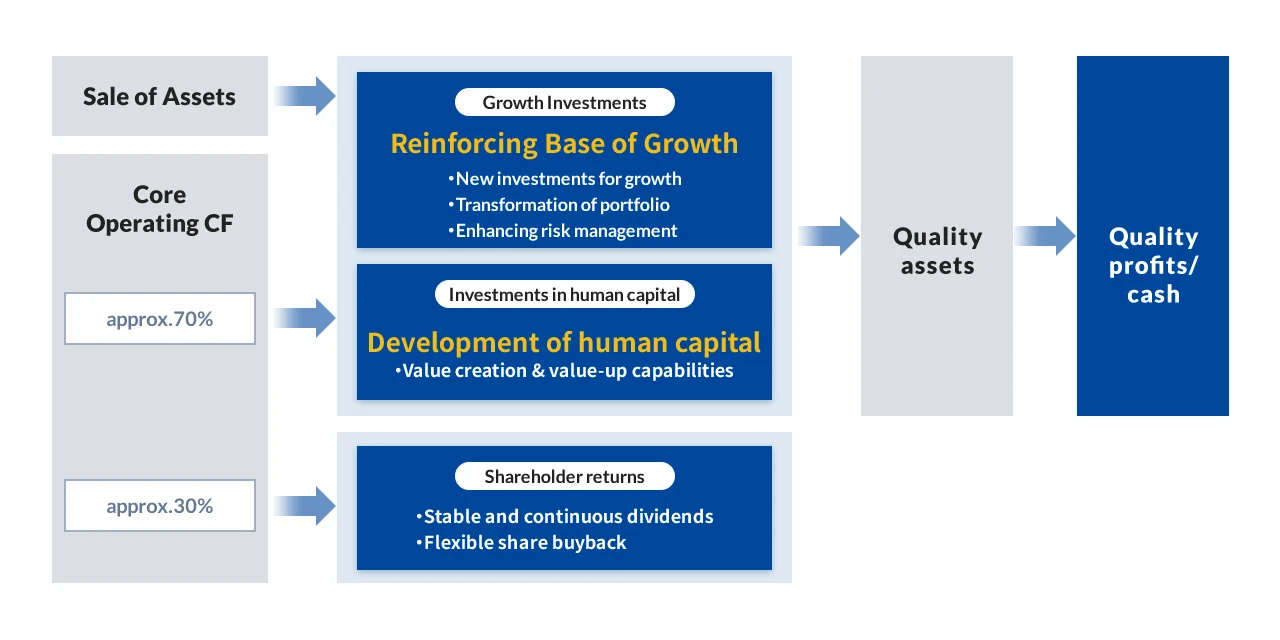

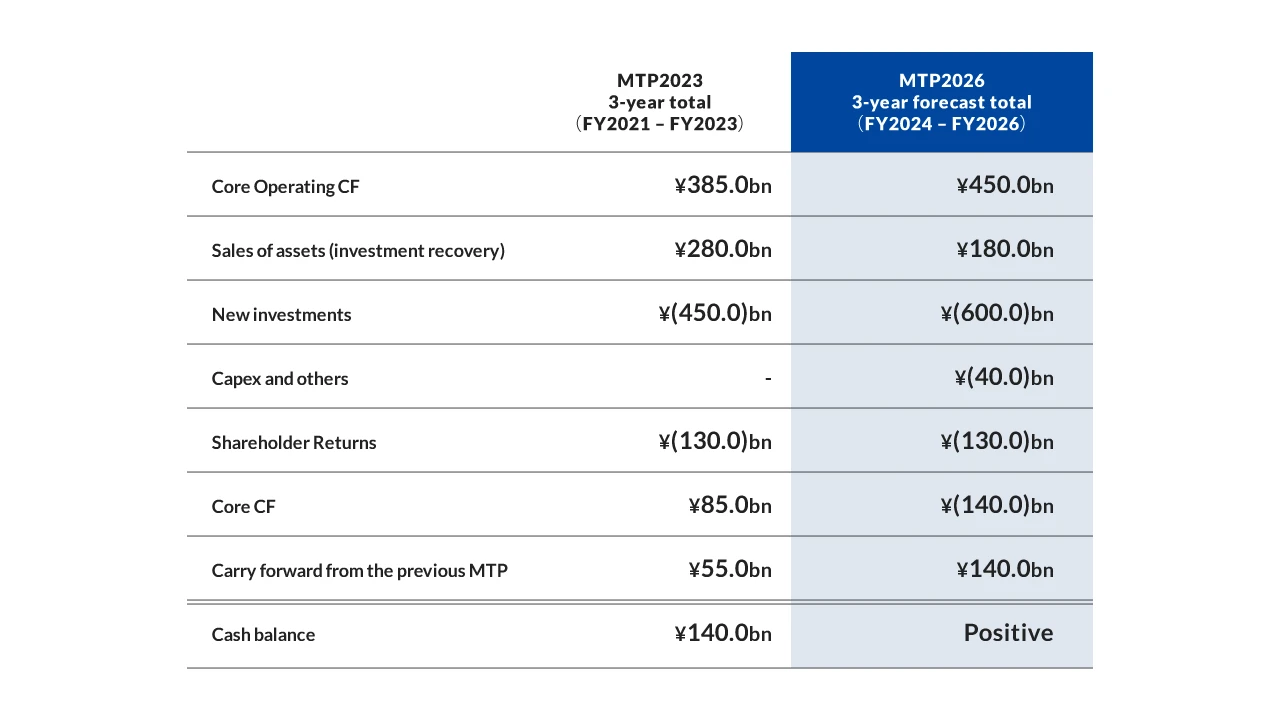

Cash Flow Management

Cash flow management: Implementing growth/human capital investments and shareholder returns aimed at further growth by using the cash generated from our businesses and the proceeds from sale of assets as a source of funds.

Cash allocation Policy: Allocating approx. 70% of the core operating CF to growth/human capital investments and approx. 30% to shareholder returns.

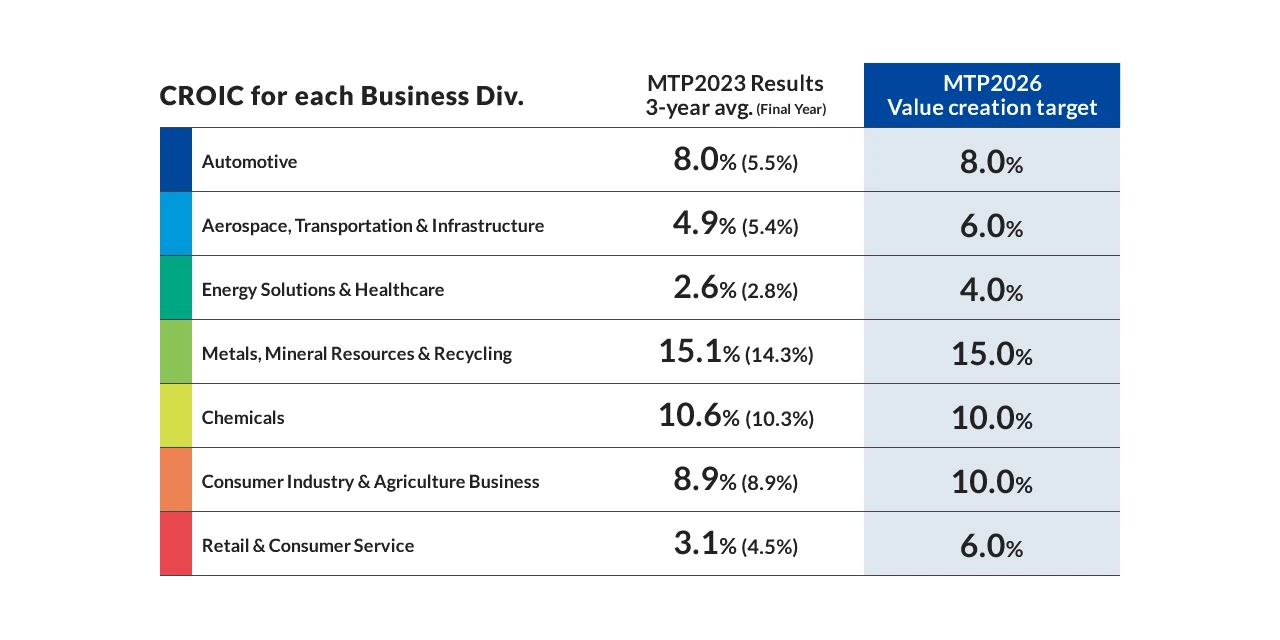

Value Creation Measurement and Evaluation

For Medium-term Management Plan 2026, setting CROIC value creation targets which each division shall aim to achieve to reach ROE 15% at Next Stage. We conduct numerical monitoring and implement improvement measures.

Shareholder Returns

Explanatory Materials

Medium-term Management Plan 2026 –Set for Next Stage-

(May 1, 2024)

In May 2024, Sojitz Corporation launched Medium-term Management Plan 2026 -Set for Next Stage-, its new three-year medium-term management plan.

Outline of Medium-term Management Plan 2026

-Set for Next Stage-

(November 27, 2023)

Sojitz Corporation hereby announces the formulation of the Outline of Medium-term Management Plan 2026 for the next medium-term management plan to be implemented for the period between FY2024 and FY2026.